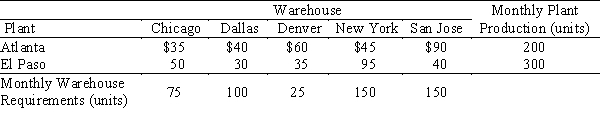

Al Bergman, staff traffic analyst at the corporate headquarters of Computer Products Corporation (CPC), is developing a monthly shipping plan for the El Paso and Atlanta manufacturing plants to follow next year. These plants manufacture specialized computer workstations that are shipped to five regional warehouses. Al has developed these estimated requirements and costs:  Determine how many workstations should be shipped per month from each plant to each warehouse to minimize monthly shipping costs, and compute the total shipping cost.

Determine how many workstations should be shipped per month from each plant to each warehouse to minimize monthly shipping costs, and compute the total shipping cost.

a.

Use the minimum cost method to find an initial feasible solution.

b.

Use the transportation simplex method to find an optimal solution.

c.

Compute the optimal total shipping cost.

Definitions:

Expected Return

A statistical measure of the mean or average return from an investment, considering historical or anticipated performance, often used in financial analysis.

Market Return

The total return of an investment market, comprising both capital gains and dividends or interest, over a given period.

Risk-Free Rate

The theoretical return on an investment with no risk of financial loss, typically represented by the yield on government bonds.

Beta

A measurement of a stock's volatility in relation to the overall market; a beta above 1 indicates that the stock's price is more volatile than the market, while a beta below 1 indicates less volatility.

Q11: Algebraic methods such as the simplex method

Q22: For an M/G/1 system with λ =

Q32: To use the transportation simplex method,<br>A) there

Q33: The Sea View Resort uses a multiple-channel

Q35: The dual variable represents<br>A) the marginal value

Q35: All quarterly time series contain seasonality.

Q37: The variable to enter into the basis

Q62: Diagram the servers and arrivals in the

Q64: When the number of agents exceeds the

Q76: Decision alternatives are structured so that several