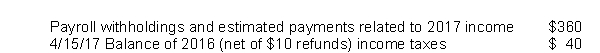

During 2017, a state has the following cash collections related to state income taxes  1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

1/15/18 payroll withholdings and estimated payments related to 2017 income $ 30

2/15/18 payroll withholdings and estimated payments related to 2017 income $ 35

3/15/18 payroll withholdings and estimated payments related to 2017 income $ 25

4/15/18 Balance of 2017 (net of $5 refunds) income taxes $ 45

Assuming that the state defines "available" as the maximum period allowable for property taxes, what is the amount of revenue that will be recognized in the 2017 government-wide financial statements related to state income taxes?

Definitions:

Verbal Promise

An agreement or commitment made orally rather than in written form; its enforceability varies depending on the nature of the agreement and the context under law.

Executor

A person or institution appointed by a testator to carry out the terms of their will.

Charitable Tax Relief

Financial deductions available to taxpayers who make contributions to legally recognized nonprofit organizations.

Valid and Enforceable

Pertaining to a contract or agreement that is legally binding and can be upheld in a court of law.

Q5: Financial statements, no matter how prepared, do

Q11: Permanent funds are classified as<br>A) Governmental funds.<br>B)

Q14: The amount of interest payable (assuming an

Q22: Overlapping debt refers to the obligations of

Q31: Samuel Corp. has provided the following information

Q35: A governmental entity has formally integrated the

Q38: Unlike individuals and businesses, governments cannot seek

Q62: Income taxes are classified as ad valorem

Q69: Which of the following is NOT a

Q129: Urban, Inc. provides the following data: <img