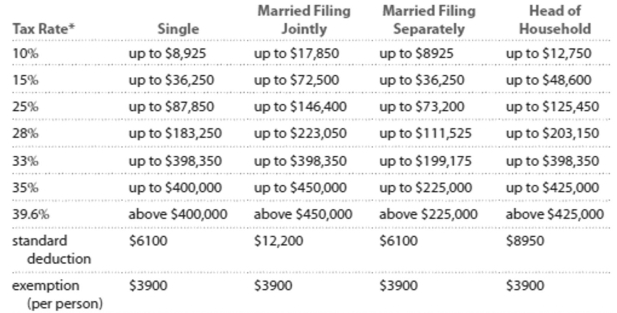

Solve the problem. Refer to the table if necessary. 2013 Marginal Tax Rates, Standard Deductlons, and Exemptlons**

"Each higher marginal rate begins where the prior one leaves off. For example, for a single person, the marginal rate affects income starting at , which is where the rate leaves off, and continuing up to .

" This table ignores the effects of (i) exemption and deduction phase-outs that apply to high-income taxpayers and (ii) the alternative minimum tax (AMT) that affects many middle-and high-income taxpayers.

-Kelly earned wages of $87,240, received $4814 in interest from a savings account, and contributed $ 6070 to a tax deferred retirement plan. She was entitled to a personal exemption of $3900 and had

Deductions totaling $9049. Find her gross income.

Definitions:

Sample Size

The number of observations or data points collected in a study or used in a statistical analysis.

Vertical Axis

The perpendicular line in a graph or chart representing the range of one of the variables under consideration.

Horizontal Axis

The x-axis in a graph, typically used to represent the independent variable or scale of measurement.

Widths

Widths refer to the measure of the extent of something from side to side; in data visualization, it could refer to the thickness of lines or bars.

Q49: Actual temperature on a given day and

Q61: Mark earned $40,208 from wages as a

Q106: Write as a decimal. 390%<br>A)3.9<br>B)0.39<br>C)39<br>D)3.91

Q106: Carla earned wages of $53,687, received $1731

Q184: As an executive of a large software

Q199: A documentary which appeared on a TV

Q206: The table below shows the number

Q209: A poll conducted the day before the

Q212: The time it take Claudia to

Q227: Determine the total payment over the term