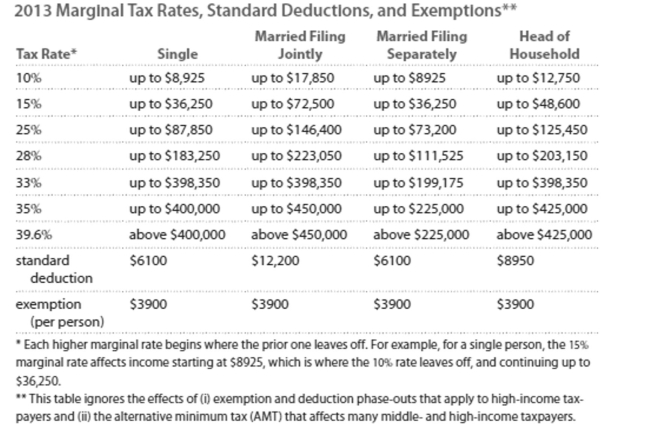

Solve the problem. Refer to the table if necessary.

-Jim earned wages of $89,118, received $5002 in interest from a savings account, and contributed $ 6342 to a tax deferred retirement plan. He was entitled to a personal exemption of $3900 and had

Deductions totaling $8797. Find his adjusted gross income.

Definitions:

Top-Team Turnover

The rate at which an organization's highest-ranking executives leave their positions over a certain period.

Concurrent Pay Structures

Compensation systems where employees performing similar roles or tasks receive pay rates based on multiple factors simultaneously, such as experience and performance.

Life Cycle

A series of stages through which an entity (such as a product, project, or organism) passes during its lifetime, from inception to termination or renewal.

Task Functions

Specific activities or duties that contribute directly towards the accomplishment of a group or organization's objectives.

Q81: Choice 1: 30 -year fixed rate

Q86: Jeff earned wages of $48,267, received $1837

Q135: Raul is planning to invest his money

Q139: Find the savings plan balance after 4

Q144: The colors of the houses in a

Q154: The following is a set of

Q185: Round to the nearest thousandth: 1.1983<br>A)1.20<br>B)1.199<br>C)1.19<br>D)1.198

Q214: Suppose you have a student loan of

Q217: 941 employees is \% of 729

Q217: If you sell a stock for more