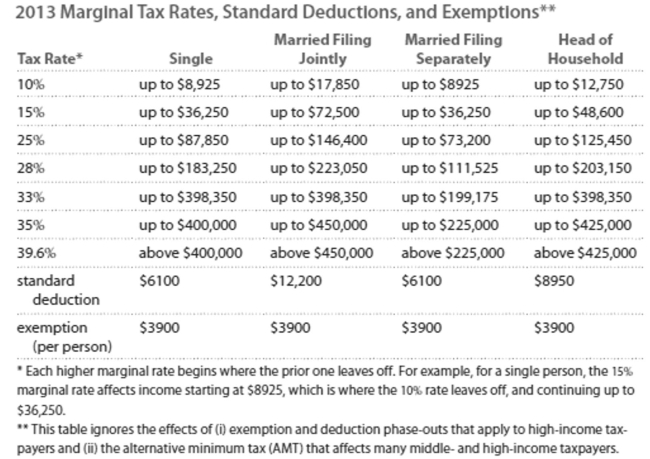

Solve the problem. Refer to the table if necessary.

-Kelsey earned $65,208 in wages. Conner earned $65,208, all in dividends and long-term capital gains. Calculate the overall tax rate for each, including both FICA and income taxes. Assume they

Are both single and take the standard deduction. Note that long-term capital gains and dividends

Are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax

Brackets.

Definitions:

Attitudes

Mental inclinations shown through assessing a specific entity with a certain level of liking or disliking.

Desires

Strong feelings of wanting or wishing for something to happen.

GRIT Strategy

GRIT strategy is a psychological approach focusing on perseverance and passion for long-term goals, emphasizing consistency of interests and the ability to persist through obstacles.

Nuclear Attack

The use of nuclear weapons against an enemy with the intention of causing massive destruction and loss of life.

Q57: What is the compound interest formula

Q81: Which of the following pairs of variables

Q102: Juan won't have to pay any taxes

Q111: The table lists the winners of

Q118: In which year(s)during the period 1960-2010 is

Q138: <span class="ql-formula" data-value="8 x - 10 =

Q164: The table below shows the result

Q178: You have money in an account at

Q202: $5000 deposit at an APR of 5%

Q243: Suppose you are 25 years old and