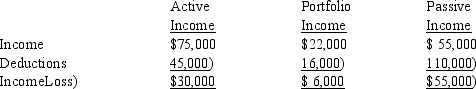

If a taxpayer has the following for the current year:  I. If the taxpayer is a regular corporation, taxable income from the three activities is a loss of $19,000. II. If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant, taxable income is $11,000.

I. If the taxpayer is a regular corporation, taxable income from the three activities is a loss of $19,000. II. If the taxpayer is an individual and the passive income is related to a rental real estate activity in which the taxpayer is an active participant, taxable income is $11,000.

Definitions:

Chloroplast

An organelle found in plant and algae cells where photosynthesis takes place, converting light energy into chemical energy stored in glucose.

Thylakoid Membrane

A membrane-bound compartment inside chloroplasts and cyanobacteria responsible for the light-dependent reactions of photosynthesis.

Stroma

The supportive framework of a biological cell, tissue, or organ, or the fluid-filled inner space of chloroplasts in plants.

Thylakoid Compartment

A component within chloroplasts of plants and algae where the light-dependent reactions of photosynthesis take place.

Q2: Which of the following payments are deductible?

Q8: The information that follows applies to the

Q51: Which income tax concepts/constructs might taxpayers who

Q69: A taxable entity has the following capital

Q77: Ronald, a single taxpayer, purchased 300 shares

Q83: Any corporate capital loss not used in

Q85: Helena and Irwin are married taxpayers who

Q85: William, a single taxpayer, has $3,500 state

Q103: LeRoy has the following capital gains and

Q117: Angel owns a gourmet Mexican restaurant. His