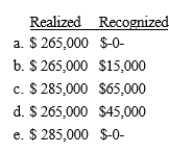

Charlotte purchases a residence for $105,000 on April 13, 2006. On July 1, 2012, she marries Howard and they use Charlotte's house as their principal residence. On May 12, 2014, they sell their home for $390,000, incurring $20,000 of selling expenses and purchase another residence costing $350,000. What is their realized and recognized gain?

Definitions:

Age-Related Condition

Health issues or diseases that become more common as individuals get older, such as arthritis, heart disease, Alzheimer's, and cancer.

Exercise

Exercise is physical activity that is planned, structured, and repetitive for the purpose of conditioning the body.

Lexicon

The set of words known by a person, used in a specific language, or related to a particular field of study.

Grammatical Aspects

Language components that convey how an action, event, or state, denoted by a verb, extends over time.

Q12: Smokey purchases undeveloped land in 1999 for

Q21: Nigel and Frank form NFS, Inc. an

Q33: To obtain the rehabilitation expenditures tax credit

Q33: During 2006, Charles purchased 1,000 shares of

Q36: Tim has a 25% interest in Hill

Q66: Sergio is a 15% partner in the

Q75: An interpretative regulation is issued when Congress

Q81: Cisco and Carmen are both in their

Q88: Which of the following is/are correct regarding

Q103: LeRoy has the following capital gains and