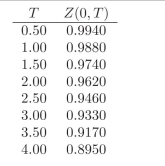

You are given the following discount factors:  You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

You are told that the price of a European Call option on a 2-year ?xed rate bond paying 5% semiannually, with T =2andK = 101 is 4.6155. While the price of a European Put option with the exact same speci?cation is: 3.0500. Are the securities adequately priced?

Definitions:

Eponym

A term or name derived from the name of a person, whether real or fictional, often used in medicine, science, and other fields to commemorate discoverers or inventors.

Abstracting

The process of extracting essential information from a larger set of data or text to summarize or create a distilled version of the original content.

External Cause Codes

Codes used in medical classification to describe the circumstances or events that cause an injury or health condition.

Volunteer Activity

Volunteer activity encompasses any action or service performed willingly by an individual without financial or material compensation.

Q1: You are given the following discount factors:

Q3: How close should the value of the

Q4: How is the multivariate Ito's lemma defined?

Q7: How is a 95% conficende interval defined?

Q10: Randi Corp. is considering the replacement of

Q12: What is an Asian Interest Rate Option?

Q12: Using risk neutral pricing obtain the value

Q74: The systematic follow-up on a capital project

Q93: Which of the following is (are) a

Q102: If Tower uses total-cost pricing formulas, the