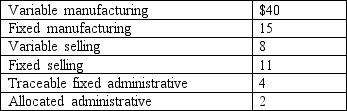

Deltones, a manufacturer of computer peripherals, has excess capacity. The company's Alabama plant has the following per-unit cost structure for item no. 89:

The traceable fixed administrative cost was incurred at the Alabama plant; in contrast, the allocated administrative cost represents a "fair share" of Deltones' corporate overhead. Alabama has been presented with a special order of 5,000 units of item no. 89 on which no selling cost will be incurred. The proper relevant cost in deciding whether to accept this special order would be:

Definitions:

Leasehold

An interest in a property, allowing possession but not ownership, for a specified period under a lease.

Legal Interests

Rights or claims to property, assets, or obligations that are recognized and protected by law.

Mortgaged

A status indicating that a property is subject to a mortgage, a loan in which the property acts as security for the repayment of the loan.

Franchised Stores

Retail outlets that operate under a license from a brand or company, allowing them to sell its products or services.

Q5: The overhead cost performance report includes spending

Q7: When preparing an NPV analysis on the

Q9: Does the 2-factor Vasicek model fit the

Q9: What does the Feynman-Kac formula say on

Q23: Krate Inc. is considering a $600,000 investment

Q31: Racine Corporation has excess capacity. If the

Q48: Listed below are five variances (and possible

Q53: Marker Sail Company plans to purchase $4.5

Q62: The following data pertain to Arctic Company's

Q78: Balanced scorecards contain a number of factors