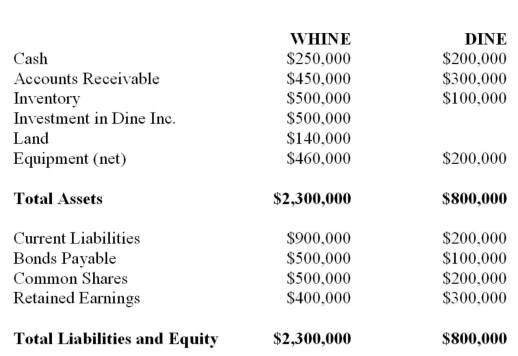

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2012. chapters) the shares) :  Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. The amount appearing under equipment on the December 31, 2012 Consolidated Balance Sheet would be:

Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. The amount appearing under equipment on the December 31, 2012 Consolidated Balance Sheet would be:

Definitions:

Q2: The Financial Statements of Plax Inc. and

Q6: Which of the following was NOT a

Q9: Assuming use of the step-down method, over

Q14: Telecom Inc has decided to purchase the

Q14: On January 1, 2013, some residents of

Q21: Out-of-pocket costs are defined as the benefit

Q23: The cost of resources supplied but unused

Q26: A business combination involves a contingent consideration.

Q36: Which of the following accounting standards have

Q78: What is the overhead rate for partners,