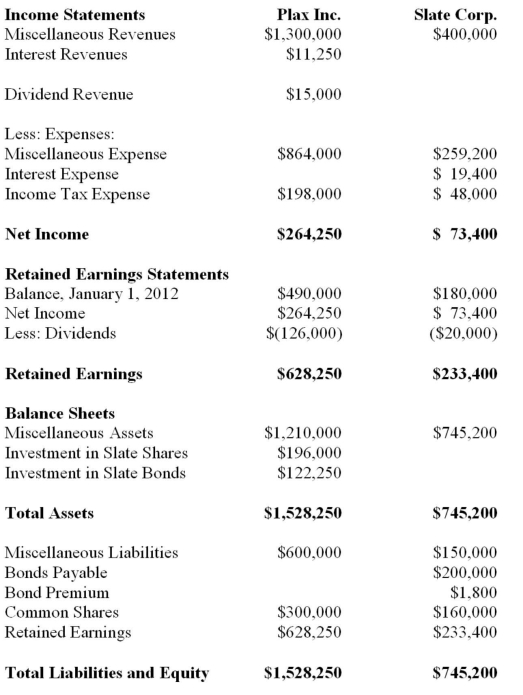

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 are shown below:  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a summary of intercompany bond transactions. Be sure to show the gain or loss for each company as well as the effect on the consolidated entity.

Definitions:

Independent Existence

A state or condition in which an individual lives or operates without reliance on others for daily needs or decisions.

Fetus

A developing mammal or human from the end of the embryonic stage to birth, characterized by rapid growth and the maturation of organs and systems.

Erect Heads

The physiological characteristic of holding the head up straight, often associated with alertness or attention.

Preterm

A term referring to babies born before 37 weeks of gestation, which are considered earlier than the full term of pregnancy.

Q1: Which of the following is classified as

Q2: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q5: Conversion costs are:<br>A) direct material, direct labor,

Q9: How are realized gains from the sale

Q11: When a contingent consideration arising from a

Q11: On June 30, 2012, Parent Company sold

Q15: Kho Inc. purchased 90% of the voting

Q16: The economic order quantity is approximately:<br>A) 203

Q17: The Financial Statements of Plax Inc. and

Q20: Buana Fide is a local charity which