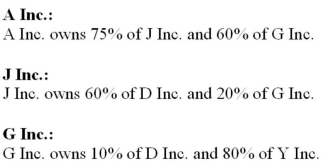

All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:

All intercompany investments are accounted for using the equity method. The Net Incomes for these companies for the year ended December 31, 2012 were as follows:  Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:

Unrealized intercompany profits (pre-tax) earned by the various companies for the year ended December 31, 2012 are shown below:  All companies are subject to a 25% tax rate. How much is A Inc.'s Consolidated Net Income for 2012?

All companies are subject to a 25% tax rate. How much is A Inc.'s Consolidated Net Income for 2012?

Definitions:

Cross-hedge

A hedging strategy using a contract that has price movements correlated with, but not identical to, the asset being hedged.

Long Futures Contract

An agreement to buy a particular commodity or financial instrument at a predetermined price at a specified time in the future, indicating the buyer's bullish outlook.

Asset Price

The current market value or price at which an asset, such as a stock, bond, or commodity, can be bought or sold.

Potential Loss

The amount of money that could be lost in an investment, considering possible outcomes under various scenarios, noting the risk involved.

Q3: LEO Inc. acquired a 60% interest in

Q5: How should a not-for-profit organization value inventories

Q7: The following balance sheets have been prepared

Q9: Big Guy Inc. purchased 80% of the

Q10: GNR Inc. owns 100% of NMX Inc.

Q11: How should investment income earned on donation

Q30: Travon and Tony (T & T) Enterprises

Q38: Big Guy Inc. purchased 80% of the

Q46: The point in a joint production process

Q56: If the total cost of alternative A