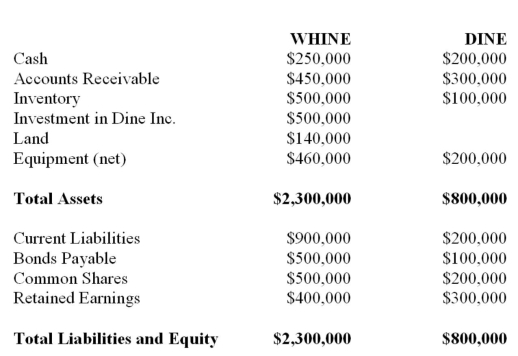

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2012. The Balance Sheets of both companies on that date are shown below (after Whine acquired the shares) :  Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be the amount of cash appearing on Whine's December 31, 2012 Consolidated Balance Sheet (after the issue of shares to Chompster) ?

Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be the amount of cash appearing on Whine's December 31, 2012 Consolidated Balance Sheet (after the issue of shares to Chompster) ?

Definitions:

Citric Acid Cycle

The Citric Acid Cycle, also known as the Krebs cycle, is a series of chemical reactions used by all aerobic organisms to release stored energy through the oxidation of acetyl-CoA.

Pyruvate

A key intermediate in several metabolic pathways, including glycolysis, where it is the end product, and can be further processed to lactate, enter the Krebs cycle, or lead to the synthesis of amino acids.

Glucose Transporter

Proteins that facilitate the transport of glucose across cell membranes, playing crucial roles in energy supply.

Cytoplasm

The jelly-like substance within a cell that contains organelles, cytosol, and cytoskeletal elements.

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" On January 1,

Q25: Compound interest is interest earned not only

Q26: Big Guy Inc. purchased 80% of the

Q28: Under which of the following Consolidation Theories

Q37: Whine purchased 80% of the outstanding voting

Q39: Prime costs are comprised of:<br>A) direct materials

Q57: Do-Good Inc. is a newly formed not-for-profit

Q69: A suitable cost driver for the amount

Q75: Which of the following employees would not

Q115: Tempest Enterprises began operations on January 1,