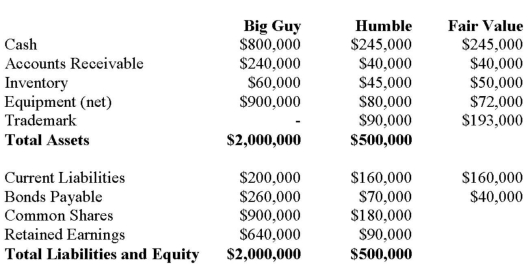

Big Guy Inc. purchased 80% of the outstanding voting shares of Humble Corp. for $360,000 on July 1, 2011. On that date, Humble Corp. had Common Stock and Retained Earnings worth $180,000 and $90,000, respectively. The Equipment had a remaining useful life of 5 years from the date of acquisition. Humble's Bonds mature on July 1, 2021. Both companies use straight line amortization, and no salvage value is assumed for assets. The trademark is assumed to have an indefinite useful life. Goodwill is tested annually for impairment. The Balance Sheets of Both Companies, as well as Humble's Fair Market Values on the date of acquisition are disclosed below:  The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:

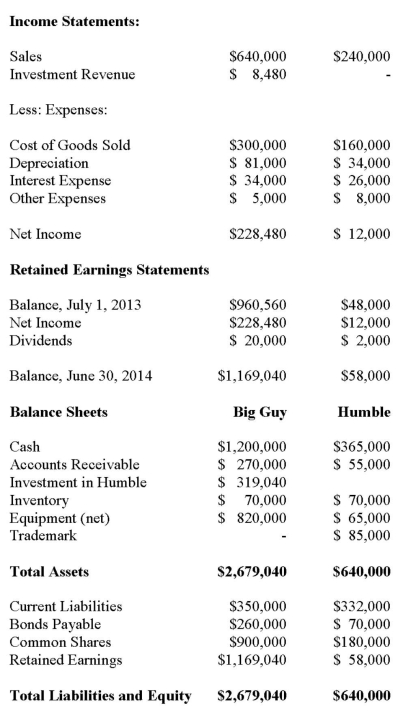

The following are the Financial Statements for both companies for the fiscal year ended June 30, 2014:  An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of non-controlling interest appearing on Big Guy's June 30, 2014 Consolidated Income Statement would be:

An impairment test conducted in September 2012 on Big Guy's goodwill resulted in an impairment loss of $10,000 being recorded. Both companies use a FIFO system, and Humble's entire inventory on the date of acquisition was sold during the following year. During 2014, Humble Inc. borrowed $20,000 in Cash from Big Guy Inc. interest free to finance its operations. Big Guy uses the Equity Method to account for its investment in Humble Corp. Assume that the entity method applies. The amount of non-controlling interest appearing on Big Guy's June 30, 2014 Consolidated Income Statement would be:

Definitions:

Transition Phase

A period or stage of change from one state, condition, or phase to another, often marked by challenges and opportunities.

Helplessness

A state of feeling powerless or unable to control or change a situation.

Bottoming Out

Reaching a lowest or worst point, often used in the context of addiction, from which recovery can begin.

Personal Loss

The experience of losing something significant in one's life, which can include loss of a loved one, divorce, job loss, or the loss of personal health, leading to various emotional responses.

Q10: Company A makes an offer to purchase

Q24: Marshall Welding uses the step-down method of

Q37: Assume that the heights of bookcases

Q37: Assume that a managerial accountant regularly communicates

Q43: ABC123 Inc has decided to purchase 100%

Q44: SNZ Inc. purchased machinery and equipment in

Q53: A not-for-profit organization receives a restricted contribution

Q57: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $70,500. B)

Q68: Soprano Corporation allocates administrative costs on the

Q110: The average cost per student when 16