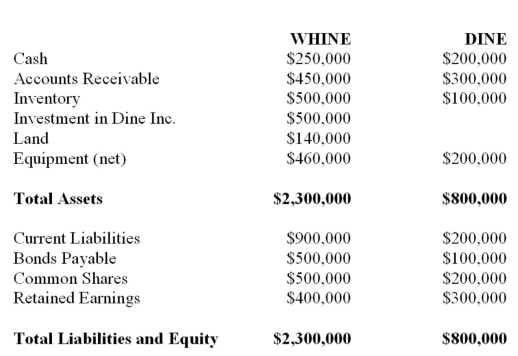

Whine purchased 80% of the outstanding voting shares of Dine Inc. on December 31, 2012. The Balance Sheets of both companies on that date are shown below (after Whine acquired the shares) :  Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be Whine's ownership interest in Dine following Chompster's purchase of shares in Dine?

Also on December 31, 2012 (after the financial statements appearing above had been prepared) Chompster Inc., one of Whine's main competitors has agreed to acquire an equity interest in Dine Inc. As a result of the agreement, Dine Inc. would issue another 8,000 shares (over and above the 32,000 shares it currently has outstanding) to Chompster for $20 per share. The acquisition differential on the date of acquisition was attributed entirely to equipment, which had a remaining useful life of ten years from the date of acquisition. Whine Inc. uses the equity method to account for its investment in Dine Inc. There were no unrealized intercompany profits on December 31, 2012. What would be Whine's ownership interest in Dine following Chompster's purchase of shares in Dine?

Definitions:

Z-statistic

The Z-statistic is a type of standard score that indicates how many standard deviations an element is from the mean, used in hypothesis testing for normal distributions.

Standard Error

A measure that describes the distribution of sample means around the population mean in a sampling distribution.

Standard Deviation

A measure of the amount of variation or dispersion of a set of values; indicates how much the values in a data set differ from the mean.

Variability

A measure of how much scores in a data set differ from each other and from the mean, indicating the spread or dispersion of the data points.

Q5: Big Guy Inc. purchased 80% of the

Q10: On January 1, 2012, Hanson Inc. purchased

Q10: Which of the following is NOT used

Q20: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" Prepare

Q25: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q39: Prime costs are comprised of:<br>A) direct materials

Q43: Under which accounting standards is the reporting

Q48: A Inc. is contemplating a Business combination

Q74: Manufacturing overhead is applied to production.<br>A. Describe

Q108: Which one of the following costs would