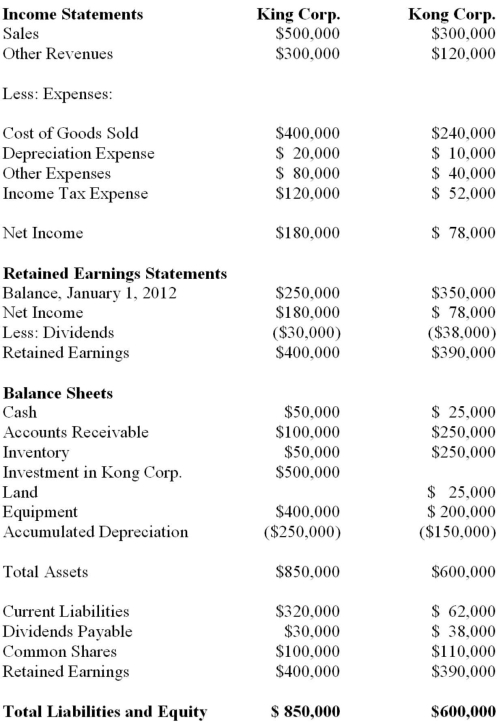

King Corp. owns 80% of Kong Corp. and uses the cost method to account for its investment, chapters) Corp. for the Year ended December 31, 2012 are shown below:  Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

Other Information: ▪King sold a tract of Land to Kong at a profit of $10,000 during 2012. This land is still the property of Kong Corp.

▪On January 1, 2012, Kong sold equipment to King at a price that was $20,000 higher than its book value. The equipment had a remaining useful life of 4 years from that date.

▪On January 1, 2012, King's inventories contained items purchased from Kong for $10,000. This entire inventory was sold to outsiders during the year. Also during 2012, King sold Inventory to Kong for $50,000. Half this inventory is still in Kong's warehouse at year end. All sales are priced at a 25% mark-up above cost, regardless of whether the sales are internal or external.

▪Kong's Retained Earnings on the date of acquisition amounted to $350,000. There have been no changes to the company's common shares account.

▪Kong's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a Fair value that was $20,000 higher than its book value. This inventory was sold to outsiders during 2012.

▪A Patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $15,000. The patent had an estimated useful life of 3 years.

▪There was a goodwill impairment loss of $4,000 during 2012.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization. What would be the non-controlling Interest amount appearing on King's Consolidated Statement of Financial Position at January 1, 2012?

Definitions:

Square Feet

A unit of area measurement equal to a square that is one foot on each side.

Bouquets

Arrangements of flowers that are typically gathered at the stems and can be given as gifts for various occasions.

Production Function

A mathematical relationship that describes how inputs like labor and capital are transformed into output.

J/L Ratio

The ratio of job vacancies to labor, often used to describe the labor market's health or tightness.

Q15: The provisions of sections 302 and 404

Q19: The interest rate used when we discount

Q22: RXN's year-end is on December 31. On

Q22: John Inc and Victor Inc for its

Q23: LEO Inc. acquired a 60% interest in

Q30: Give examples of each of the four

Q43: King Corp. owns 80% of Kong Corp.

Q48: A controller is normally involved with preparing

Q66: Discuss the reason for (1) allocating overhead

Q71: Find the critical t-value that corresponds