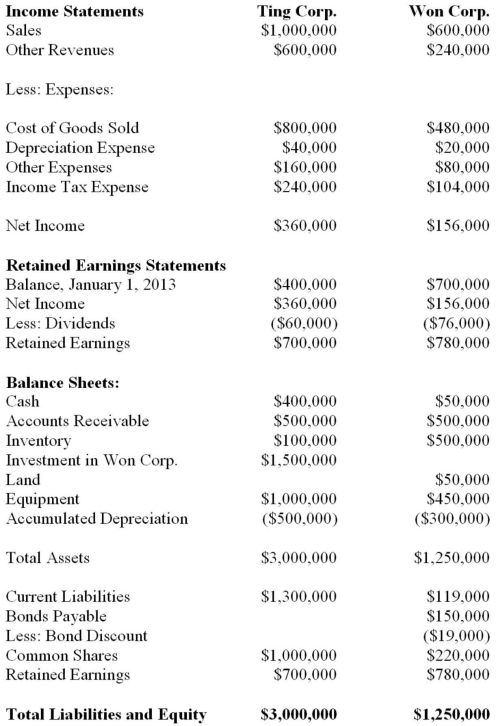

Ting Corp. owns 75% of Won Corp. and uses the Cost Method to account for its Investment, chapters) for the Year ended December 31, 2013 are shown below:  Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

Other Information: ▪Won sold a tract of land to Ting at a profit of $20,000 during 2013. This land is still the property of Ting Corp.

▪On January 1, 2013, Won sold equipment to Ting at a price that was $20,000 lower than its book value. The equipment had a remaining useful life of 5 years from that date.

▪On January 1, 2013, Won's inventories contained items purchased from Ting for $120,000. This entire inventory was sold to outsiders during the year. Also during 2013, Won sold inventory to Ting for $30,000. Half this inventory is still in Ting's warehouse at year end. All sales are priced at a 20% mark-up above cost, regardless of whether the sales are internal or external.

▪Won's Retained Earnings on the date of acquisition amounted to $700,000. There have been no changes to the company's common shares account.

▪Won's book values did not differ materially from its fair values on the date of acquisition with the following exceptions:

▪Inventory had a fair value that was $50,000 higher than its book value.

▪A patent (which had not previously been accounted for) was identified on the acquisition date with an estimated fair value of $20,000. The patent had an estimated useful life of 5 years.

▪There was a goodwill impairment loss of $10,000 during 2013.

▪Both companies are subject to an effective tax rate of 40%.

▪Both companies use straight line amortization exclusively.

▪On January 1, 2013, Ting acquired half of Won's bonds for $60,000.

▪The bonds carry a coupon rate of 10% and mature on January 1, 2033. The initial bond issue took place on January 1, 2013. The total discount on the issue date of the bonds was $20,000.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when consolidated statements are prepared. What would be the non-controlling interest amount appearing on Ting's Consolidated Statement of Financial Position on January 1, 2013?

Definitions:

Observational Learning

The process of acquiring new behaviors or knowledge by watching and imitating others.

Group Size

The number of individuals forming a defined or structured set, impacting dynamics and interactions within.

Incorrect Choice

A decision that turns out to be wrong or less optimal compared to other available options.

Electric Shocks

Sudden discharges of electricity through a part of the body, which can cause varying degrees of harm, from mild discomfort to severe injury.

Q2: Errant Inc. purchased 100% of the outstanding

Q7: You received a $5,000 loan at the

Q10: A business combination involves a contingent consideration.

Q17: Which of the following is not an

Q26: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) It will

Q27: On January 1, 2012, Hanson Inc. purchased

Q51: Find Corp and has elected to use

Q53: Alcor and Vax Inc, both Canadian private

Q58: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) In a

Q60: King Corp. owns 80% of Kong Corp.