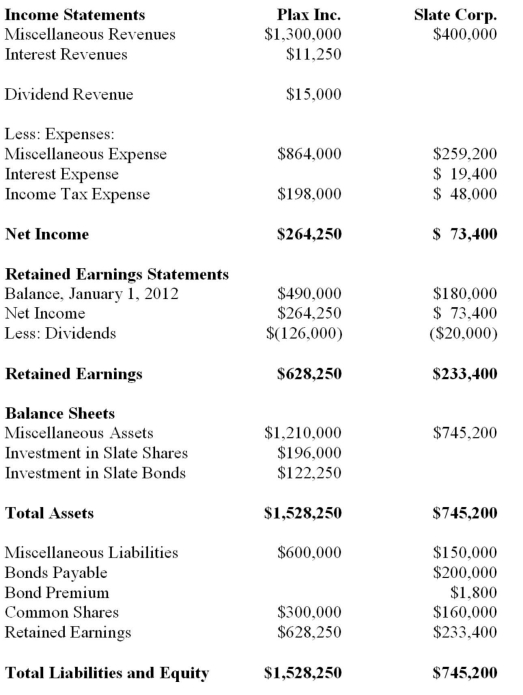

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 are shown below:  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a summary of intercompany interest revenues and expenses.

Definitions:

Law

A system of rules created and enforced through social or governmental institutions to regulate behavior.

Charter of Rights

A formal document outlining the rights and freedoms guaranteed to the citizens or members of an organization or country.

Canadians

Refers to individuals from Canada, a country in North America known for its multicultural society and natural landscapes.

Legislation

Laws and legal statutes enacted by a governmental body to regulate, authorize, sanction, grant, declare, or restrict.

Q1: Whine purchased 80% of the outstanding voting

Q2: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q6: On December 31, 2012, A Company has

Q32: Ting Corp. owns 75% of Won Corp.

Q39: Parent and Sub Inc. had the following

Q44: SNZ Inc. purchased machinery and equipment in

Q51: Describe the economic characteristics of sunk costs

Q72: Hernandez Systems began business on January 1

Q77: The grade point averages for 10

Q115: Tempest Enterprises began operations on January 1,