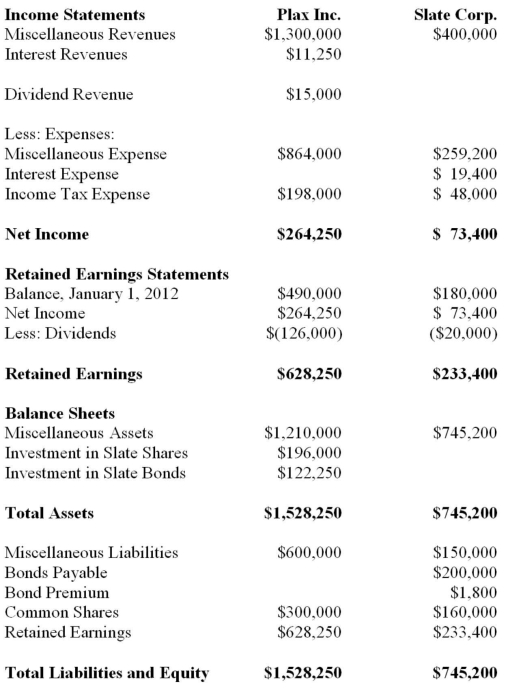

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 are shown below:  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare Plax's Consolidated Income Statement for the year ended December 31, 2012. Show the allocation of Consolidated Net Income between the controlling and non-controlling shareholders.

Definitions:

Southwest Airlines

An American airline known for its low-cost travel options, customer-friendly policies, and an organizational culture emphasizing employee satisfaction and operational efficiency.

Social Media Engagement

The interaction between organizations or individuals with their audience on social media platforms, measured by activities such as likes, shares, and comments.

Connected

Refers to the state of being linked or having established communications with other entities, often used in the context of internet connectivity or networks.

Community

A group of individuals sharing common interests, values, or goals, often connected by geographic proximity, social ties, or online platforms.

Q6: Tempest Industries has two service departments (General

Q12: LEO Inc. acquired a 60% interest in

Q37: Whine purchased 80% of the outstanding voting

Q41: If the parent company used the equity

Q46: Jay Inc. owns 80% of Tesla Inc.

Q51: Company Y purchases a controlling interest in

Q56: Which of the following is required when

Q60: Construct a <span class="ql-formula" data-value="90

Q79: Total costs are $180,000 when 10,000 units

Q90: When 5,000 units are produced variable costs