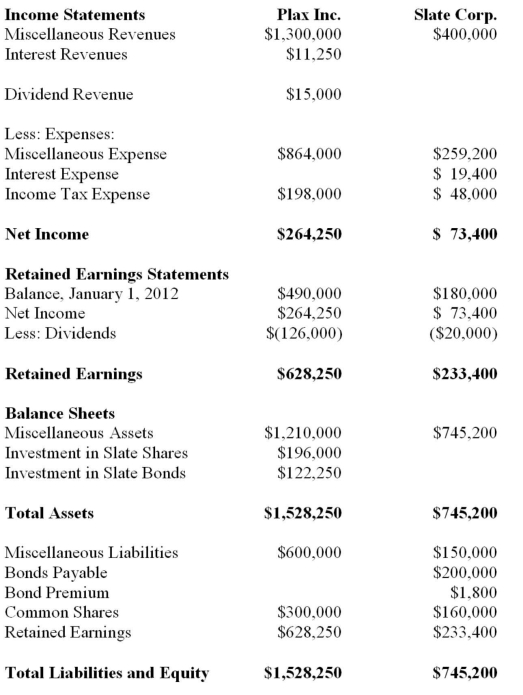

The Financial Statements of Plax Inc. and Slate Corp for the Year ended December 31, 2012 chapters)  Other Information:

Other Information:

▪Plax acquired 75% of Slate on January 1, 2008 for $196,000, when Slate's retained earnings was $80,000 and the acquisition differential was attributable entirely to goodwill. There were impairment losses to the goodwill of $6,400 and $1,600 in 2009 and 2012 respectively.

▪Plax uses the cost method to account for its investment.

▪Slate has 10% par value bonds outstanding in the amount of $200,000 which mature on December 31, 2015. The bonds were issued at a premium. On January 1, 2012 the unamortized premium amounted to $2,400 Slate uses the straight line method to amortize the premium.

▪On January 1, 2012, Plax acquired $120,000 face value of Slate's bonds for $123,000 Plax also uses the straight line method to amortize any bond premium or discount.

▪Both companies are subject to a 40% Tax rate.

▪Gains and losses from intercompany bond holdings are to be allocated to the two companies when Consolidated Financial Statements are prepared. Prepare a detailed calculation of consolidated retained earnings as at January 1, 2012. Do not prepare a Statement of Retained Earnings for this requirement.

Definitions:

Type 1 Diabetes

An autoimmune condition where the pancreas produces little to no insulin, leading to elevated blood sugar levels.

Susceptibility

The likelihood or predisposition to be affected by a particular condition, disease, or harm.

Genetic Risk

The likelihood of developing a disease or condition based on inherited genetic factors.

Furosemide (Lasix)

A diuretic medication used to treat fluid build-up due to heart failure, liver scarring, or kidney disease.

Q4: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" A) $100,000. B)

Q11: Jay Inc. owns 80% of Tesla Inc.

Q14: Which of the following statements pertaining to

Q17: Which of the following employees of a

Q27: King Corp. owns 80% of Kong Corp.

Q36: Under dual-cost allocation, fixed costs are allocated

Q41: Duff Inc. owns 75% of Paddy Corp.

Q50: Which of the following statements is correct?<br>A)

Q55: Rin owns 90% of Stempy Inc. On

Q76: In most situations, managerial accounting reports solve