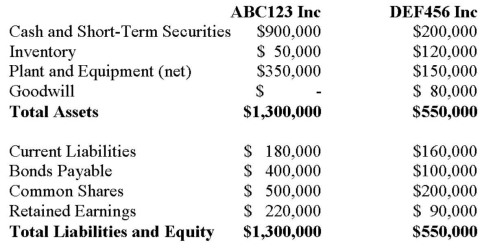

ABC123 Inc has decided to purchase 100% the voting shares of DEF456 for $400,000 in Cash on July 1, 2012. On the date, the balance sheets of each of these companies were as follows:  On that date, the fair values of DEF456 Assets and Liabilities were as follows:

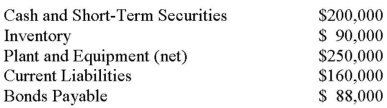

On that date, the fair values of DEF456 Assets and Liabilities were as follows:  In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Based on the information provided: a) Calculate the amount of Goodwill arising from this combination. b) Prepare the journal entry to record ABC123's acquisition of DEF456's shares. c) Prepare ABC123's Consolidated Balance Sheet immediately following its acquisition of DEF123's voting shares.

In addition to the above, an independent appraiser deemed that DEF456 Inc. had trademarks with a fair market value of $100,000 which had not been accounted for. In turn, ABC123's fair market values were equal to their book values with the exception of the Company's Inventory and Plant and Equipment, which were said to have Fair Market Values of $30,000 and $480,000, respectively. Based on the information provided: a) Calculate the amount of Goodwill arising from this combination. b) Prepare the journal entry to record ABC123's acquisition of DEF456's shares. c) Prepare ABC123's Consolidated Balance Sheet immediately following its acquisition of DEF123's voting shares.

Definitions:

Provides Feedback

The process of giving information or observations back to the initial source, often used to improve or adjust performance or behavior.

Discharge Teaching

Education provided to patients and their caregivers before leaving the hospital to ensure safe and effective care continuation at home.

Antinausea Medication

Drugs designed to prevent or alleviate nausea and vomiting.

Mouth Care

The routine practices for maintaining oral hygiene and health, including brushing, flossing, and dental check-ups.

Q23: <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB2504/.jpg" alt=" The

Q34: On January 1, 2012, Hanson Inc. purchased

Q34: A simple random sample of size

Q37: Appendix A of IFRS 3 provides an

Q40: Company A has decided to purchase 100%

Q40: GNR Inc. owns 100% of NMX Inc.

Q56: The margin of error of a

Q58: City Hospital has two service departments (Patient

Q59: Which of the following statements is correct?<br>A)

Q69: For the following conditions, determine if