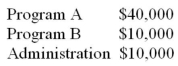

XYZ is a local charity that commenced operations on January 1, 2014. XYZ uses an encumbrance system to manage costs. For the following partial data provided, prepare the journal entry to record that transaction. In addition, specify which fund or funds must be used to record the entry. a) Revenue deferred earlier in the year in the amount of $5,000 was recognized. b) Pledges receivable in the amount of $10,000 were collected in full. c) Accounts payable and wages payable amounting to $10,000 and $5,000 were paid. d) Government grants amounted to $50,000, half of which was received. The balance is expected by late 2015. The grants may be applied to any of the organization's programs. e) Total Wage costs amounted to $60,000 which breaks down as follows:  25% of these expenses are still payable at the end of 2014. f) A wealthy local businessman donated $100,000 to be held in endowment, with the interest earned to be unrestricted. g) The investments in an endowment fund earned interest in the amount $3,000. h) Amortization expense for the year amounted to $10,000.

25% of these expenses are still payable at the end of 2014. f) A wealthy local businessman donated $100,000 to be held in endowment, with the interest earned to be unrestricted. g) The investments in an endowment fund earned interest in the amount $3,000. h) Amortization expense for the year amounted to $10,000.

Definitions:

Revenues

Earnings derived from standard business activities, factoring in reductions and allowances for goods returned.

Expenses

Outflows or other uses of assets or incurrences of liabilities during a period from delivering or producing goods, rendering services, or carrying out other activities that constitute the entity's ongoing major operations.

Liability

Legal obligations related to finances that a business incurs throughout its operational processes.

Accounting Equation

The fundamental equation of double-entry bookkeeping: Assets = Liabilities + Owner's Equity.

Q10: GNR Inc. owns 100% of NMX Inc.

Q18: Ting Corp. owns 75% of Won Corp.

Q29: Big Guy Inc. purchased 80% of the

Q31: Construct a <span class="ql-formula" data-value="99

Q33: Assuming that A acquired a controlling interest

Q48: A Inc. is contemplating a Business combination

Q49: Company A makes a hostile take-over bid

Q83: The random variable x represents the number

Q99: Many people think that a national

Q122: Find the <span class="ql-formula" data-value="z"><span