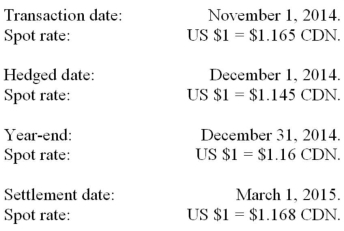

RXN's year-end is on December 31. On November 1, 2014 when the U.S. dollar was worth $1.165 CDN, RXN sold merchandise to an American client for $300,000. Full payment of this invoice was expected by March 1, 2015. On December 1, the spot rate was $1.1450 CDN and the three-month forward rate was $1.1250 CDN. In order to minimize its Foreign Exchange risk and exposure, RXN entered into a contract with its bank on December 1, 2014 to deliver $300,000 U.S. in three months' time. The spot rate at year-end was $1.16 CDN and the forward rate from December 31, 2014 to March 1, 2015 was $1.14 CDN. On March 1, 2015, RXN received the $300,000 U.S. from its client and settled its contract with the bank. The forward contract was to be accounted for as a fair value hedge of the US dollar receivable. Significant dates and exchange rates pertaining to this transaction are as follows:  What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

What is the amount of RXN's foreign exchange gain or loss prior to its hedge?

Definitions:

Fixed Exchange Rates

A government or central bank policy setting the value of its currency in relation to another currency or a basket of currencies.

Consolidated Statements

Financial statements that present the assets, liabilities, equity, income, expenses, and cash flows of a parent company and its subsidiaries as a single entity.

Future Date

A specific day in the future, identified for the occurrence of a particular event or for the completion of a specified task or agreement.

U.S. Dollars

The authorized fiscal medium of the United States, extensively employed as a reference and backup currency all over the world.

Q22: A Company sells inventory to its Subsidiary,

Q26: Kho Inc. purchased 90% of the voting

Q27: King Corp. owns 80% of Kong Corp.

Q29: SNZ Inc. purchased machinery and equipment in

Q37: Suppose a population has a mean

Q37: According to government data, the probability that

Q42: A farmer was interested in determining

Q55: High temperatures in a certain city for

Q56: Which of the following statements is correct

Q57: The random variable <span class="ql-formula"