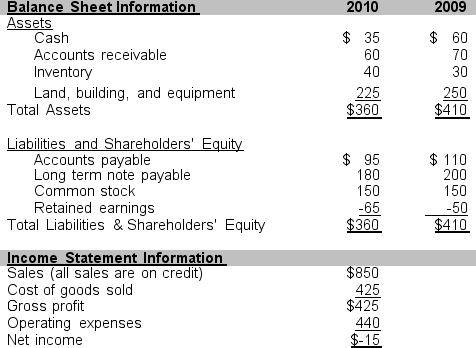

Use the information that follows taken from Campbell Company's financial statements for the years ending December 31, 2010 and 2009 to answer problems 45 through 48.

-Calculate Campbell's debt to equity ratio as of December 31, 2009 and as of December 31, 2010. Also assume that in Campbell's industry, the industry average debt to equity ratio is 2.75 as of December 31, 2009 and as of December 31, 2010.

A) Campbell's debt to equity ratio improved from 2009 to 2010.

B) Campbell's debt to equity ratio was better than average for the industry both years.

C)

C) Campbell's debt to equity is worse than average for the industry for both years.

D) Both a and b above, but not

Definitions:

Asset Management

The process of effectively managing and investing in assets to increase their value or yield.

Debt Management

The process of overseeing and managing a company's or individual's debt load to maximize financial stability and minimize interest expense.

Profitability

Profitability is a measure of the efficiency and financial success of a business or project, indicated by the ability to generate income greater than its expenses and costs.

Times Interest Earned

Times interest earned is a financial ratio that measures a company's ability to meet its debt obligations by comparing its income before interest and taxes to its interest expenses.

Q12: The following information related to the marketable

Q25: Taylor Company has the following financial data

Q62: Polo, Inc. uses the direct write-off method

Q65: The chief investment officer of a large

Q73: Forrest's Crab House purchased Florida stone crab

Q90: Which one of the following will impact

Q90: If the balance sheet is in balance,<br>A)

Q92: Victor Corporation purchased a packaging machine on

Q99: A firm fraudulently overstated its December 31,

Q100: If a company with working capital of