TABLE 9-1

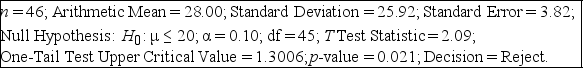

Microsoft Excel was used on a set of data involving the number of defective items found in a random sample of 46 cases of light bulbs produced during a morning shift at a plant. A manager wants to know if the mean number of defective bulbs per case is greater than 20 during the morning shift. She will make her decision using a test with a level of significance of 0.10. The following information was extracted from the Microsoft Excel output for the sample of 46 cases:

-Referring to Table 9-1, the manager can conclude that there is sufficient evidence to show that the mean number of defective bulbs per case is greater than 20 during the morning shift with no more than a 5% probability of incorrectly rejecting the true null hypothesis.

Definitions:

Frotteuristic Disorder

Disorder characterized by obtainment of sexual gratification by rubbing one’s genitals against or fondling the body parts of a nonconsenting person.

Sexual Sadism

A condition where individuals derive pleasure from inflicting pain or humiliation on others.

Sexual Masochism

A condition where sexual excitement and satisfaction depend on enduring pain, humiliation, or being bound.

Consenting Adults

Refers to individuals who are of legal age and have the capacity to make decisions about participating in activities, particularly sexual or other significant undertakings, with mutual agreement and understanding.

Q3: Referring to Table 7-1, if there are

Q14: A company selling apparel online sends out

Q17: Referring to Table 11-3, the within group

Q104: Referring to Table 11-6, the null hypothesis

Q118: Suppose a 95% confidence interval for μ

Q137: A manager of the credit department for

Q141: Referring to Table 10-15, suppose α =

Q171: A sampling distribution is defined as the

Q177: Which of the following types of samples

Q183: Referring to Table 11-6, based on the