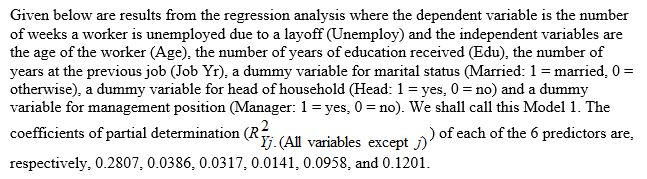

TABLE 14-17

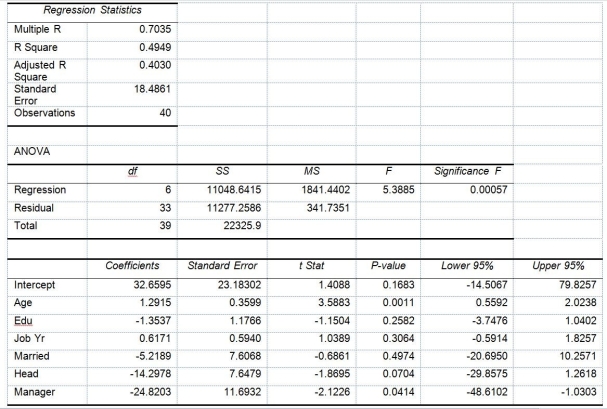

Model 2 is the regression analysis where the dependent variable is Unemploy and the independent variables are

Age and Manager. The results of the regression analysis are given below:

-Referring to Table 14-17 Model 1, there is sufficient evidence that all of the explanatory variables are related to the number of weeks a worker is unemployed due to a layoff at a 10% level of significance.

Definitions:

Projection

A defense mechanism in psychology where individuals attribute their own thoughts, feelings, or attributes to someone else.

Perceptual Defence

A psychological concept where an individual subconsciously resists recognizing or accepting information that conflicts with their personal beliefs or expectations.

Implicit Personality Theory

The assumptions or biases that people naturally make about the characteristics and traits of others based on limited observations.

Primacy

The principle that items or information presented first in a list or sequence are more likely to be remembered or given importance.

Q7: Determining the root causes of why defects

Q8: Referring to Table 16-13, what is the

Q12: Referring to Table 17-7, an R chart

Q28: Referring to Table 15-6, what is the

Q40: Referring to Table 16-12, in testing the

Q109: Referring to Table 14-5, when the microeconomist

Q167: Referring to Table 13-7, which of the

Q192: Referring to Table 14-3, to test whether

Q279: Referring to Table 14-17 Model 1, what

Q345: Referring to Table 14-4, one individual in