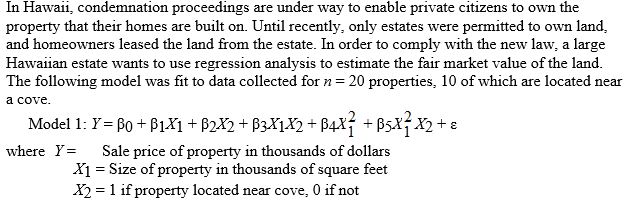

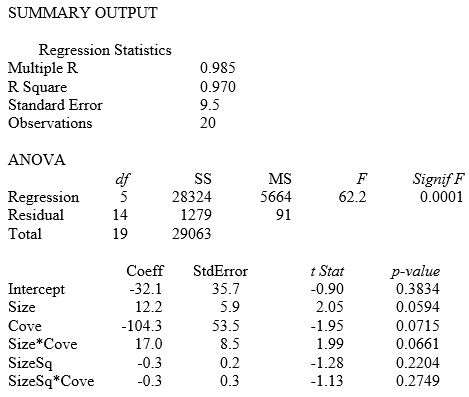

TABLE 15-2

-Referring to Table 15-2, given a quadratic relationship between sale price (Y) and property size (X₁) , what test should be used to test whether the curves differ from cove and non-cove properties?

Definitions:

Rate Of Return

The financial increment or decrement experienced in the value of an investment over a specific duration, highlighted as a percentage of the initial capital deployed.

Business Venture

A new enterprise entered into for profit, often characterized by innovation, risk, and a new market or product.

Compounded Semi-annually

The process of calculating interest on both the initial principal and the accumulated interest from previous periods twice a year.

EAR

Effective Annual Rate is the actual return on an investment or the actual interest rate of a loan, taking into account the effect of compounding interest over the period.

Q6: Referring to Table 14-1, for these data,

Q11: Referring to Table 14-19, what is the

Q13: Referring to Table 17-8, an R chart

Q50: Referring to Table 15-1, what is the

Q66: Referring to Table 16-13, the best model

Q67: Referring to Table 16-13, the best autoregressive

Q70: Referring to Table 17-4, what is the

Q87: Referring to Table 14-19, there is not

Q150: Referring to Table 14-19, what should be

Q167: Referring to Table 13-7, which of the