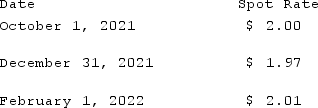

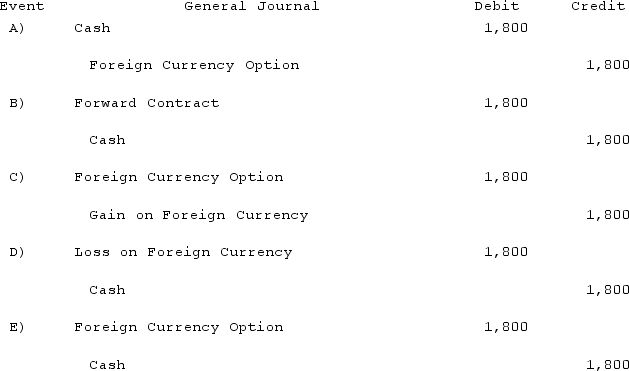

On October 1, 2021, Eagle Company forecasts the purchase of inventory from a British supplier on February 1, 2022, at a price of 100,000 British pounds. On October 1, 2021, Eagle pays $1,800 for a three-month call option on 100,000 pounds with a strike price of $2.00 per pound. The option is considered to be a cash flow hedge of a forecasted foreign currency transaction. On December 31, 2021, the option has a fair value of $1,600. The following spot exchange rates apply:  What journal entry should Eagle prepare on October 1, 2021?

What journal entry should Eagle prepare on October 1, 2021?

Definitions:

Active Interest

A keen and enthusiastic attention or involvement in a particular activity or subject.

Patient

A person who is under or has signed up for medical care.

Patient Education

The process of providing patients with information and support regarding their health condition and its management.

Comprehend Instructions

The ability to understand and follow directions or commands given by others, crucial for completing tasks accurately and efficiently.

Q10: Following are selected accounts for Green Corporation

Q13: This industry term refers to a film

Q40: A foreign subsidiary uses the first-in first-out

Q48: Which of the following best describe Coppola's

Q55: Anderson Company, a 90% owned subsidiary of

Q68: Gordon Co. reported current earnings of $580,000

Q71: Ginvold Co. began operating a subsidiary in

Q75: Peter, Roberts, and Dana have the following

Q95: One company buys a controlling interest in

Q117: When Valley Co. acquired 80% of the