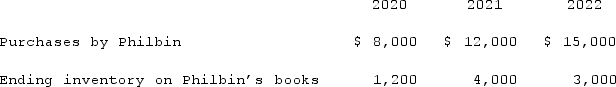

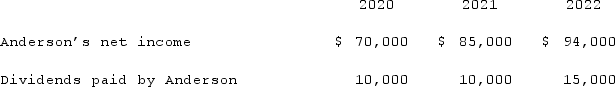

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. For consolidation purposes, what amount would be debited to cost of goods sold for the 2021 consolidation worksheet with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 transfer of merchandise?

For consolidation purposes, what amount would be debited to cost of goods sold for the 2021 consolidation worksheet with regard to the unrecognized intra-entity gross profit remaining in ending inventory with respect to the 2021 transfer of merchandise?

Definitions:

Departmental Predetermined Rates

Specific overhead rates calculated for each department within a company, used to allocate indirect costs more accurately.

Machine-Hours

A measure of the total time that machines are operated within a specific period, used for allocating manufacturing overhead costs to products.

Manufacturing Overhead

The indirect costs related to manufacturing that cannot be directly tied to a specific product, including costs of maintenance, electricity, and equipment depreciation.

Predetermined Overhead Rate

An estimated overhead rate used to allocate manufacturing overhead costs to products, calculated before the start of a period.

Q12: A subsidiary of Reynolds Inc., a U.S.

Q14: Lisa Co. paid cash for all of

Q17: A partnership began its first year of

Q17: Coyote Corp. (a U.S. company in Texas)had

Q25: A local partnership has two partners, Jim

Q27: An investor should always use the equity

Q27: Choose either the Time Warner or Disney

Q64: Kennedy Company acquired all of the outstanding

Q77: Prater Inc. owned 85% of the voting

Q93: Wilkins Inc. acquired 100% of the voting