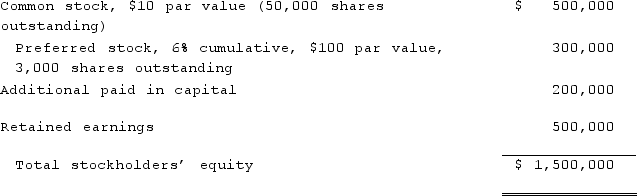

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  Compute the noncontrolling interest in Smith at date of acquisition.

Compute the noncontrolling interest in Smith at date of acquisition.

Definitions:

Entrepreneur

An individual who undertakes the creation, organization, and ownership of an innovative business with potential for growth and financial reward.

Franchising

A business model that allows individuals to operate their own outlets of a larger chain, sharing in the brand, products, and operational support.

Royalties

Payments made to the original creators or owners of intellectual property for the right to use their work.

Franchisor

A business entity that grants the right to use its brand, products, and operational model to an individual or company (franchisee) in exchange for a fee.

Q3: All of the following are examples of

Q12: A subsidiary of Reynolds Inc., a U.S.

Q26: Which New Hollywood auteur struggled throughout the

Q41: Name the Stanley Kubrick film that utilizes

Q51: What is the impact on the noncontrolling

Q61: Wilson owned equipment with an estimated life

Q77: On April 1, 2020, Shannon Company, a

Q77: Boerkian Co. started 2021 with two assets:

Q94: Wilkins Inc. acquired 100% of the voting

Q109: In an acquisition where 100% control is