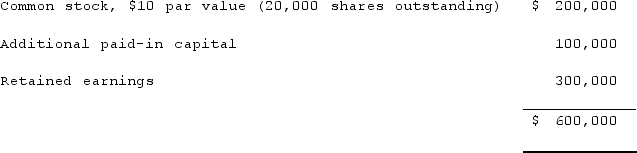

Panton, Inc. acquired 18,000 shares of Glotfelty Corp. several years ago for $30 per share when Glotfelty had a book value of $450,000. Before and after that time, Glotfelty's stock traded at $30 per share. At the present time, Glotfelty reports the following stockholders' equity:

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Glotfelty issues 5,000 shares of previously unissued stock to the public for $40 per share. None of this stock is purchased by Panton.Describe how this transaction would affect Panton's books.

Definitions:

Employment Insurance

A government program that provides temporary financial assistance to unemployed workers.

Company Pension Plan

A retirement savings program provided by an employer, offering employees a fixed payout upon retirement based on their earnings history, tenure, and age.

Psychological Counselling

Professional guidance provided by a psychologist focusing on resolving personal or psychological challenges.

Compensation System Designing

The process of establishing and creating a structured pay and benefits package for employees within an organization.

Q15: The top ten grossing films of 2016

Q16: Which studio eventually bought the rights to

Q29: All of the following data points are

Q41: Anderson Company, a 90% owned subsidiary of

Q42: When consolidating parent and subsidiary financial statements,

Q45: On January 1, 2021, Rhodes Co. owned

Q68: Vaughn Inc. acquired all of the outstanding

Q87: When a parent uses the initial value

Q95: Perkle Co. owned a subsidiary in Belgium;

Q108: Following are selected accounts for Green Corporation