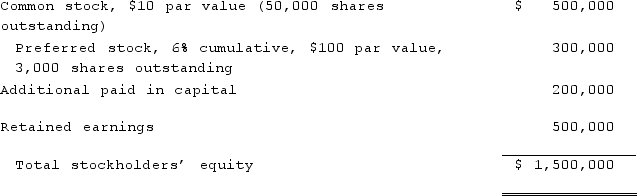

On January 1, 2021, Nichols Company acquired 80% of Smith Company's common stock and 40% of its non-voting, cumulative preferred stock. The consideration transferred by Nichols was $1,200,000 for the common and $124,000 for the preferred. There was no premium in the value of consideration transferred. Any excess acquisition-date fair value over book value is considered goodwill. The capital structure of Smith immediately prior to the acquisition is:  If Smith's net income is $100,000 in the year following the acquisition,

If Smith's net income is $100,000 in the year following the acquisition,

Definitions:

E-books

Digital versions of books, readable on electronic devices such as computers, tablets, and e-readers.

National Defense

Government-provided security against foreign aggression, encompassing the military forces and other defense measures.

Common Resource

A resource like air or water that is not owned by anyone, is available for everyone to use, but can become depleted if overused.

Excludable

A characteristic of a good for which it is possible to prevent individuals from enjoying its benefits unless they pay for it.

Q12: How is the fair value of a

Q17: What term describes "films based on ideas

Q19: Wolff corporation owns 70% of the outstanding

Q32: Danbers Co. owned 75% of the common

Q34: On January 1, 2021, Harrison Corporation spent

Q67: Goodman, Pinkman, and White formed a partnership

Q69: On October 1, 2021, Eagle Company forecasts

Q77: A company had common stock with a

Q84: Marshall Co. was formed on January 1,

Q118: The balance sheets of Butler, Inc. and