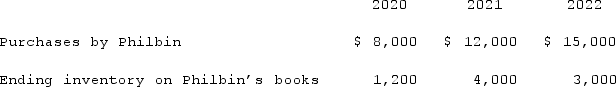

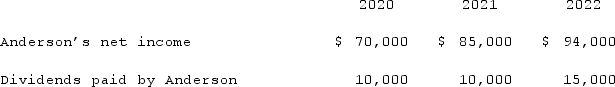

Anderson Company, a 90% owned subsidiary of Philbin Corporation, transfers inventory to Philbin at a 25% gross profit rate. The following data are available pertaining specifically to Philbin's intra-entity purchases from Anderson. Anderson was acquired on January 1, 2020.  Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends.

Assume the equity method is used. The following data are available pertaining to Anderson's income and dividends. Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

Assuming there are no excess amortizations associated with the consolidation, and no other intra-entity asset transfers, compute the net income attributable to the noncontrolling interest of Anderson for 2021.

Definitions:

Economic Profit

The surplus remaining after total costs are subtracted from total revenue, considering both explicit and implicit costs.

Marginal Revenue

The additional income earned by a firm from selling one more unit of a good or service.

Marginal Cost

The cost of producing one additional unit of a good or service, often used in decision-making to determine the optimal level of production.

Average Total Cost

The total cost of production divided by the quantity of output produced, representing the cost per unit of output.

Q31: Pepe, Incorporated acquired 60% of Devin Company

Q37: Anderson Company, a 90% owned subsidiary of

Q39: A partnership began its first year of

Q41: Thomas Inc. had the following stockholders' equity

Q56: A partnership began its first year of

Q63: The financial statement amounts for the Atwood

Q69: P, L, and O are partners with

Q89: Jackson Company acquires 100% of the stock

Q119: Which of the following is a not

Q121: Stark Company, a 90% owned subsidiary of