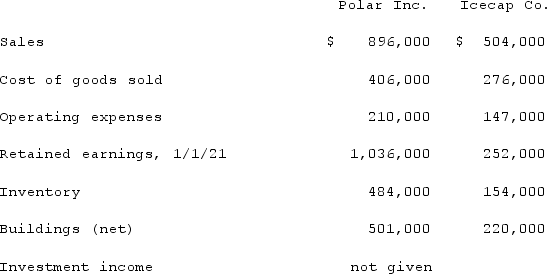

Several years ago, Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.The following selected account balances were from the individual financial records of these two companies as of December 31, 2021:

Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2020 and $165,000 in 2021. Of this inventory, $39,000 of the 2020 transfers were retained and then sold by Icecap in 2021, while $55,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i)Cost of Goods Sold; (ii)Inventory; and (iii)Net income attributable to the noncontrolling interest.

Assume that Polar sold inventory to Icecap at a markup equal to 25% of cost. Intra-entity transfers were $130,000 in 2020 and $165,000 in 2021. Of this inventory, $39,000 of the 2020 transfers were retained and then sold by Icecap in 2021, while $55,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i)Cost of Goods Sold; (ii)Inventory; and (iii)Net income attributable to the noncontrolling interest.

Definitions:

Tracking Impact

The process of monitoring and evaluating the effects or outcomes of a specific action, campaign, or strategy over time.

Advertising Campaign

A series of related advertisements focusing on a common theme, message, and set of goals, aimed at reaching a particular audience.

Sales Promotion

A marketing strategy involving temporary incentives to encourage the purchase or sale of a product or service.

University Bookstore

A university bookstore is a retail establishment located on or near a college campus, specializing in selling textbooks, academic materials, and university-branded merchandise.

Q19: Which statement is true concerning unrecognized profits

Q21: Vaughn Inc. acquired all of the outstanding

Q50: Following are selected accounts for Green Corporation

Q58: Clark Stone purchases raw material from its

Q59: Jones, Incorporated acquires 15% of Anderson Corporation

Q86: Renfroe, Inc. acquired 10% of Stanley Corporation

Q88: What should an entity evaluate when making

Q93: Following are selected accounts for Green Corporation

Q94: Stiller Company, an 80% owned subsidiary of

Q95: On January 1, 2020, Smeder Company, an