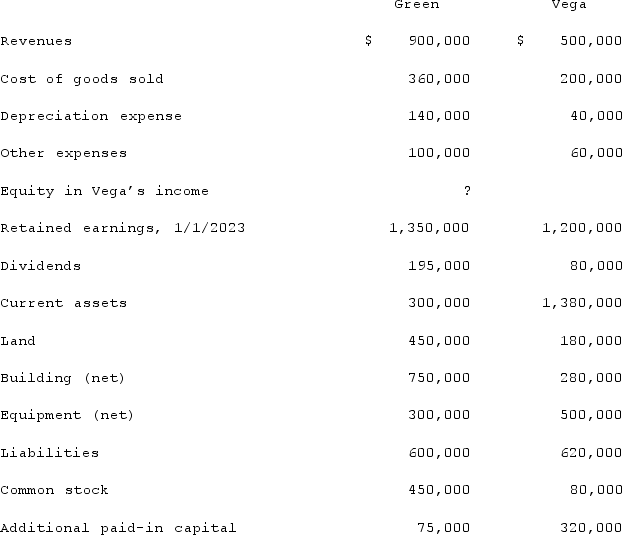

Following are selected accounts for Green Corporation and Vega Company as of December 31, 2023. Several of Green's accounts have been omitted.  Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated common stock.

Green acquired 100% of Vega on January 1, 2019, by issuing 10,500 shares of its $10 par value common stock with a fair value of $95 per share. On January 1, 2019, Vega's land was undervalued by $40,000, its buildings were overvalued by $30,000, and equipment was undervalued by $80,000. The buildings have a 20-year life and the equipment has a 10-year life. $50,000 was attributed to an unrecorded trademark with a 16-year remaining life. There was no goodwill associated with this investment.Compute the December 31, 2023, consolidated common stock.

Definitions:

Grief

The pain of loss experienced when a loved one or something dear is removed, frequently associated with grieving.

Physician-Assisted Suicide

A practice in which a doctor provides a terminally ill patient with a lethal dose of medication, upon the patient's request, which the patient can take to end their life.

Voluntary Euthanasia

The act of intentionally ending a life to relieve pain and suffering, where the individual who wishes to die makes a conscious decision to request help in dying.

Funeral Costs

The expenses incurred in the arranging, conducting, and finalizing of a funeral service.

Q27: An investor should always use the equity

Q36: On May 1, 2021, Mosby Company received

Q37: Which of the following statements is false

Q42: Which organization is responsible for establishing accounting

Q50: All of the following are true about

Q50: Flynn acquires 100 percent of the outstanding

Q53: Under modified accrual accounting, when should revenues

Q67: A parent company owns a controlling interest

Q84: Jet Corp. acquired all of the outstanding

Q99: On January 1, 2021, Anderson Company purchased