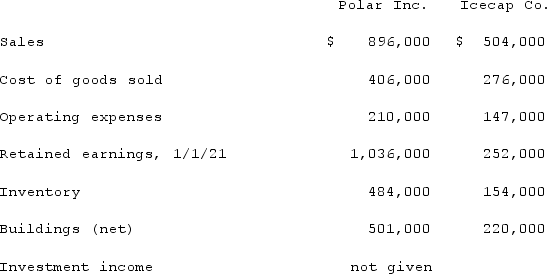

Several years ago, Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.The following selected account balances were from the individual financial records of these two companies as of December 31, 2021:

Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2020 and $112,000 in 2021. Of this inventory, $29,000 of the 2020 transfers were retained and then sold by Polar in 2021, whereas $49,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i)Cost of Goods Sold; (ii)Inventory; and (iii)Net income attributable to the noncontrolling interest.

Assume that Icecap sold inventory to Polar at a markup equal to 25% of cost. Intra-entity transfers were $70,000 in 2020 and $112,000 in 2021. Of this inventory, $29,000 of the 2020 transfers were retained and then sold by Polar in 2021, whereas $49,000 of the 2021 transfers were held until 2022.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i)Cost of Goods Sold; (ii)Inventory; and (iii)Net income attributable to the noncontrolling interest.

Definitions:

Demographic Segment

A market division based on demographic factors, such as age, race, gender, income, or education level, to refine marketing and targeting strategies.

Q9: Anderson, Inc. acquires all of the voting

Q18: On January 4, 2020, Nelson Corporation purchased

Q18: Boerkian Co. started 2021 with two assets:

Q24: Which of the following variable interests entitles

Q66: How does the use of the equity

Q67: The financial statement amounts for the Atwood

Q79: During January 2020, Nelson, Inc. acquired 30%

Q81: In comparing U.S. GAAP and International Financial

Q103: After allocating cost in excess of book

Q104: With respect to identifiable intangible assets other