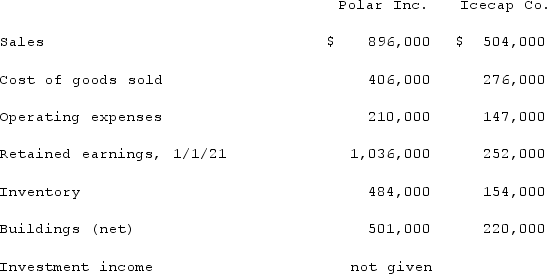

Several years ago, Polar Inc. acquired an 80% interest in Icecap Co. The book values of Icecap's asset and liability accounts at that time were considered to be equal to their fair values. Polar's acquisition value corresponded to the underlying book value of Icecap so that no allocations or goodwill resulted from the transfer.The following selected account balances were from the individual financial records of these two companies as of December 31, 2021:

Polar sold a building to Icecap on January 1, 2020 for $112,000, although the book value of this asset was only $70,000 on that date. The building had a five-year remaining useful life and was to be depreciated using the straight-line method with no salvage value.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i)Buildings (net); (ii)Operating expenses; and (iii)Net income attributable to the noncontrolling interest.

Polar sold a building to Icecap on January 1, 2020 for $112,000, although the book value of this asset was only $70,000 on that date. The building had a five-year remaining useful life and was to be depreciated using the straight-line method with no salvage value.Required:For the consolidated financial statements for 2021, determine the balances that would appear for the following accounts: (i)Buildings (net); (ii)Operating expenses; and (iii)Net income attributable to the noncontrolling interest.

Definitions:

Food Stamps

Government-issued vouchers that can be used to purchase groceries at retail stores, intended to help low-income families afford food.

Poor

Lacking sufficient money to live at a standard considered comfortable or normal in a society.

Female-Headed Households

Households that are led by a female as the primary decision-maker or head of the household.

Poverty Line

The minimum level of income deemed adequate in a particular country to live on and meet basic living needs.

Q29: Under the temporal method, which accounts are

Q33: Jackson Corp. (a U.S.-based company)sold parts to

Q35: Caldwell Inc. acquired 65% of Club Corp.

Q46: Walsh Company sells inventory to its subsidiary,

Q51: Key Company has had bonds payable of

Q62: Salem Co. had the following account balances

Q86: What theoretical argument could be made against

Q87: Several years ago, Polar Inc. acquired an

Q93: Wilkins Inc. acquired 100% of the voting

Q99: On January 1, 2021, Anderson Company purchased