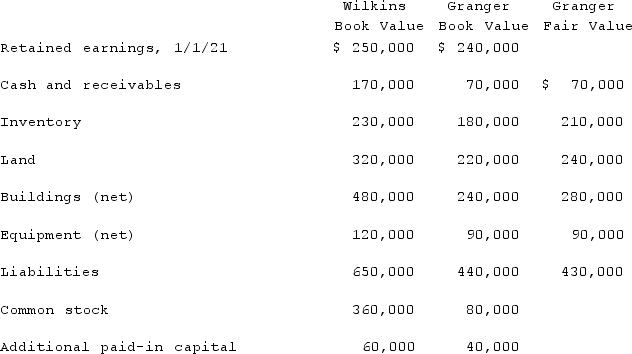

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins issued preferred stock with a par value of $260,000 and a fair value of $500,000 for all of the outstanding shares of Granger in an acquisition business combination. What will be the balance in the consolidated Inventory and Land accounts?

Assume that Wilkins issued preferred stock with a par value of $260,000 and a fair value of $500,000 for all of the outstanding shares of Granger in an acquisition business combination. What will be the balance in the consolidated Inventory and Land accounts?

Definitions:

Health Risks

Potential factors or behaviors that can lead to disease, injury, or other health problems.

Moral Hazard

A situation where one party engages in risky behavior knowing that it is protected against the risk because another party will incur the cost.

U.S. Population

The total number of residents living in the United States, as measured by census and population estimates.

Defensive Medicine

The practice by healthcare providers of ordering tests, treatments, or procedures primarily to protect themselves from litigation, rather than to benefit the patient's health.

Q1: A local partnership was considering the possibility

Q2: A strategic alliance is a(n)<br>A)organization skilled at

Q6: The following information has been taken from

Q13: Why do intra-entity transfers between the component

Q22: How are direct and indirect costs accounted

Q47: A local partnership has assets of cash

Q70: Borgin Inc. owns 30% of the outstanding

Q76: Total quality management is characterized by a

Q79: During January 2020, Nelson, Inc. acquired 30%

Q85: Beatty, Inc. acquires 100% of the voting