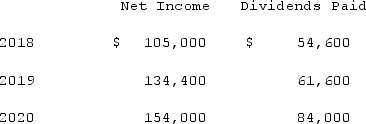

On January 1, 2018, Vacker Co. acquired 70% of Carper Inc. by paying $650,000. This included a $20,000 control premium. Carper reported common stock on that date of $420,000 with retained earnings of $252,000. A building was undervalued in the company's financial records by $28,000. This building had a ten-year remaining life. Copyrights of $80,000 were to be recognized and amortized over 20 years.Carper earned income and paid cash dividends as follows:

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

On December 31, 2020, Vacker owed $30,800 to Carper. There have been no changes in Carper's common stock account since the acquisition.Required:If the equity method had been applied by Vacker for this acquisition, what were the consolidation entries needed as of December 31, 2020?

Definitions:

Negative News

Information that delivers undesired or disappointing messages, often causing concern or distress to the receiver.

Emotional Investment

A commitment of one's feelings and emotional energy to a project, person, or idea.

Direct Approach

A straightforward method of communication where the main point is presented at the beginning of the message.

Negative News

Information or reports that convey unfavorable, adverse, or undesirable outcomes or situations.

Q8: Fargus Corporation owned 51% of the voting

Q29: Which one of the following accounts would

Q41: Prepare all journal entries in U.S. dollars

Q41: Thomas Inc. had the following stockholders' equity

Q43: Which of the following is true regarding

Q47: On January 1, 2021, the Moody Company

Q67: Under modified accrual accounting, revenues should be

Q70: Borgin Inc. owns 30% of the outstanding

Q109: In an acquisition where 100% control is

Q113: On January 1, 2021, Pride, Inc. acquired