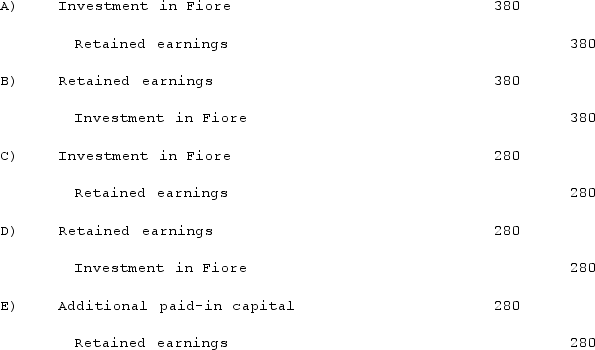

Kaye Company acquired 100% of Fiore Company on January 1, 2021. Kaye paid $1,000 excess consideration over book value, which is being amortized at $20 per year. There was no goodwill in the combination. Fiore reported net income of $400 in 2021 and paid dividends of $100.Assume the initial value method is used. In the year subsequent to acquisition, what additional worksheet entry must be made for consolidation purposes that is not required for the equity method?

Definitions:

Sold Separately

Items or services not included with the primary product and must be purchased independently.

Infringement Suit

A legal case brought against an individual or company for violating a patent, copyright, trademark, or other intellectual property rights.

Legal Expenses

Costs incurred by a business for legal services, such as attorney fees and court costs.

Goodwill

An intangible asset that arises when a business is acquired for more than the fair value of its net identifiable assets, representing the company's reputation, brand, or similar factors.

Q11: When a city collects admission fees from

Q16: Lewis Corp. acquired all of the voting

Q23: All of the following statements regarding the

Q32: The City of Ibiza maintains a collection

Q49: Palmer Corp. owned 80% of the outstanding

Q58: How do the balance sheet and statement

Q95: On January 1, 2021, Nichols Company acquired

Q103: Which of the following statements is false

Q107: Following are selected accounts for Green Corporation

Q114: Webb Company purchased 90% of Jones Company