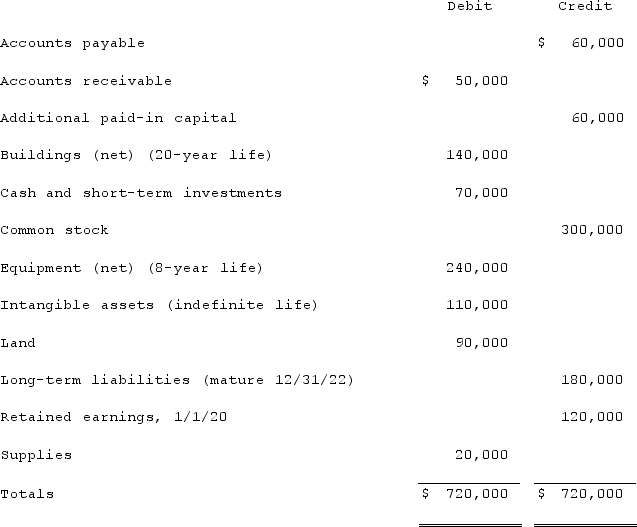

Matthews Co. acquired all of the common stock of Jackson Co. on January 1, 2020. As of that date, Jackson had the following trial balance:

During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.)Prepare consolidation worksheet entries for December 31, 2020.(B.)Prepare consolidation worksheet entries for December 31, 2021.

During 2020, Jackson reported net income of $96,000 while paying dividends of $12,000. During 2021, Jackson reported net income of $132,000 while paying dividends of $36,000. Assume that Matthews Co. acquired the common stock of Jackson Co. for $588,000 in cash. As of January 1, 2020, Jackson's land had a fair value of $102,000, its buildings were valued at $188,000, and its equipment was appraised at $216,000. Any excess of consideration transferred over fair value of assets and liabilities acquired is due to an unamortized patent to be amortized over 10 years.Matthews decided to use the equity method for this investment.Required:(A.)Prepare consolidation worksheet entries for December 31, 2020.(B.)Prepare consolidation worksheet entries for December 31, 2021.

Definitions:

Marriage Protection Act

Legislation aimed at defining marriage and protecting the institution of marriage, often from a conservative viewpoint.

Twenty-Sixth Amendment

An amendment to the U.S. Constitution that lowered the voting age from 21 to 18.

Voting Age

The legal age at which a person is granted the right to vote in public elections, typically set at 18 years in many countries.

Due Process

A constitutional principle that requires government to respect all legal rights that are owed to a person, ensuring fair procedures when it seeks to deprive a person of life, liberty, or property.

Q3: Pell Company acquires 80% of Demers Company

Q11: The Arnold, Bates, Carlton, and Delbert partnership

Q17: In a transaction accounted for using the

Q20: Ryan Company purchased 80% of Chase Company

Q25: Anderson, Inc. has owned 70% of its

Q28: From which methods can a parent choose

Q70: Annual budgets must be recorded within:<br>A)The general

Q75: Popper Co. acquired 80% of the common

Q88: Several years ago, Polar Inc. acquired an

Q110: Pepe, Incorporated acquired 60% of Devin Company