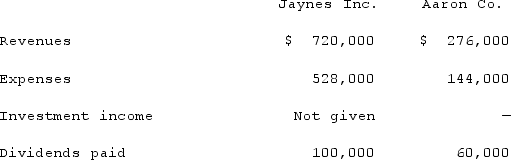

Jaynes Inc. acquired all of Aaron Co.'s common stock on January 1, 2020, by issuing 11,000 shares of $1 par value common stock. Jaynes' shares had a $17 per share fair value. On that date, Aaron reported a net book value of $120,000. However, its equipment (with a five-year remaining life)was undervalued by $6,000 in the company's accounting records. Any excess of consideration transferred over fair value of assets and liabilities acquired is assigned to an unrecorded patent to be amortized over ten years.The following figures came from the individual accounting records of these two companies as of December 31, 2020:

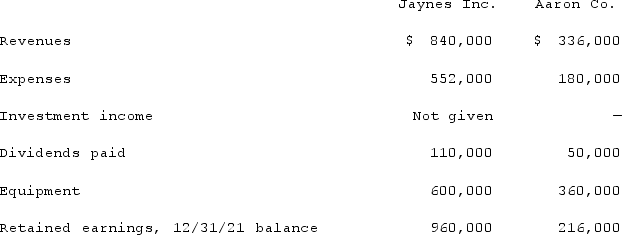

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

The following figures came from the individual accounting records of these two companies as of December 31, 2021:

What was consolidated equipment as of December 31, 2021?

What was consolidated equipment as of December 31, 2021?

Definitions:

Risk Factors

Elements or conditions that increase the likelihood of an undesirable outcome.

U.S. Teens

Individuals aged between 13 and 19 residing in the United States, encompassing a diverse group going through adolescence.

Sexually Transmitted

Referring to infections that are passed from one person to another through sexual contact.

Preventing Strategies

Approaches or methods implemented to avoid the occurrence of unwanted outcomes or diseases.

Q5: The Amos, Billings, and Cleaver partnership had

Q13: LaFevor Co. acquired 70% of the common

Q31: The financial statements for Campbell, Inc., and

Q55: Anderson Company, a 90% owned subsidiary of

Q59: The Keller, Long, and Mason partnership had

Q70: Akers Co. owned 8,000 shares (80%)of the

Q81: What is meant by the terms direct

Q82: Which of the following is false regarding

Q87: Several years ago, Polar Inc. acquired an

Q119: On January 1, 2020, Mehan, Incorporated purchased