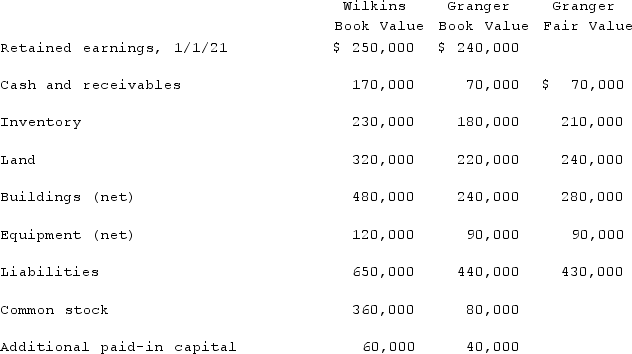

Wilkins Inc. acquired 100% of the voting common stock of Granger Inc. on January 1, 2021. The book value and fair value of Granger's accounts on that date (prior to creating the combination) are as follows, along with the book value of Wilkins's accounts:  Assume that Wilkins issued 13,000 shares of common stock with a $5 par value and a $46 fair value for all of the outstanding shares of Granger. What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1, 2021 balances) as a result of this acquisition transaction?

Assume that Wilkins issued 13,000 shares of common stock with a $5 par value and a $46 fair value for all of the outstanding shares of Granger. What will be the consolidated Additional Paid-In Capital and Retained Earnings (January 1, 2021 balances) as a result of this acquisition transaction?

Definitions:

Maturity Value

The amount that will be received at the end of a fixed income investment period, such as bonds or certificates of deposit.

Invested

The process of investing funds or capital into a project anticipating the generation of extra income or gains.

Simple Interest Rate

An interest calculation method where the interest charge is based on the original principal amount, without compounding.

Interest

The cost of borrowing money or the payment received for lending money, usually expressed as an annual percentage of the principal amount.

Q24: The partnership of Gordon, Handel, and Mitchell

Q32: Hardin, Sutton, and Williams have operated a

Q40: What would differ between a statement of

Q50: Which of the following is a governmental

Q51: What is a safe cash payment?

Q54: What is the primary objective of the

Q59: The Keller, Long, and Mason partnership had

Q64: Popper Co. acquired 80% of the common

Q87: On January 1, 2021, Nichols Company acquired

Q89: On January 1, 2021, Rhodes Co. owned