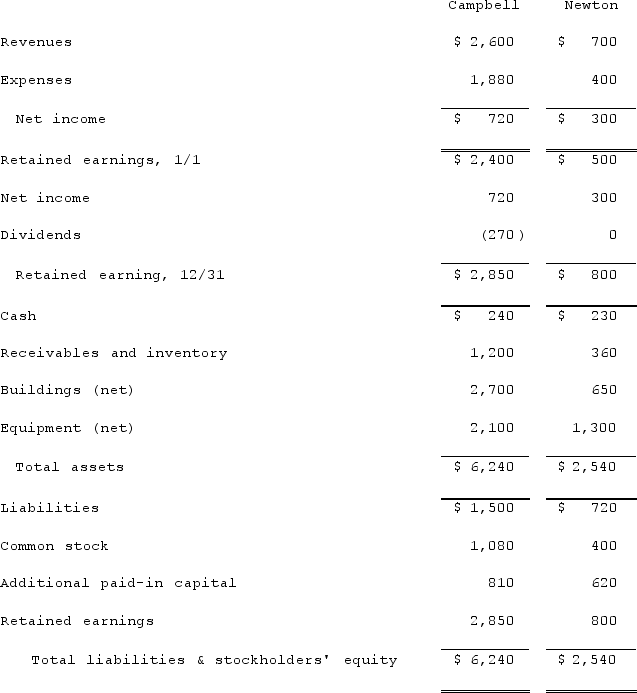

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated receivables and inventory for 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the consolidated receivables and inventory for 2021.

Definitions:

Primarily Liable

Refers to the party in a financial transaction or contractual agreement who has the direct responsibility to perform or pay.

Instrument

A formal legal document that records a right, duty, or the execution of a transaction, such as contracts, deeds, and promissory notes.

UCC

Short for Uniform Commercial Code, a comprehensive set of laws governing commercial transactions in the United States, including sales, leases, negotiable instruments, and secured transactions.

Signature

A person's name or mark written by themselves, used as a proof of intention and identity in a document.

Q5: Avery Company acquires Billings Company in a

Q36: Under modified accrual accounting, when should an

Q39: Jackson Company acquires 100% of the stock

Q47: Strickland Company sells inventory to its parent,

Q59: McLaughlin, Inc. acquires 70% of Ellis Corporation

Q67: The financial statement amounts for the Atwood

Q80: Pritchett Company recently acquired three businesses, recognizing

Q87: On January 1, 2021, Nichols Company acquired

Q93: Wilkins Inc. acquired 100% of the voting

Q96: Charleston Inc. acquired 75% of Savannah Manufacturing