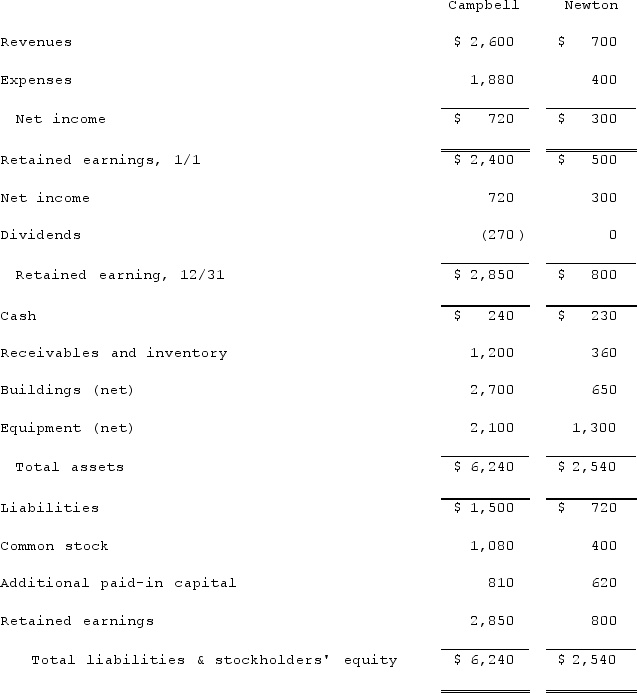

The financial statements for Campbell, Inc., and Newton Company for the year ended December 31, 2021, prior to the business combination whereby Campbell acquired Newton, are as follows (in thousands) :  On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the goodwill arising from this acquisition at December 31, 2021.

On December 31, 2021, Campbell obtained a loan for $650 and used the proceeds, along with the transfer of 35 shares of its $10 par value common stock, in exchange for all of Newton's common stock. At the time of the transaction, Campbell's common stock had a fair value of $40 per share.In connection with the business combination, Campbell paid $25 to a broker for arranging the transaction and $30 in stock issuance costs. At the time of the transaction, Newton's equipment was actually worth $1,450 but its buildings were only valued at $590.Compute the goodwill arising from this acquisition at December 31, 2021.

Definitions:

Customer Needs

The recognized desires or requirements of consumers that drive their purchasing behaviors and decisions.

Modular Design

A design approach that divides a system into smaller parts called modules, which can be independently created, modified, replaced, or exchanged with other modules.

Q6: For recognized intangible assets that are considered

Q11: The modified approach to accounting for infrastructure

Q18: Jones, Marge, and Tate LLP decided to

Q43: Virginia Corp. owned all of the voting

Q58: How do the balance sheet and statement

Q59: The Keller, Long, and Mason partnership had

Q66: How does the use of the equity

Q87: On January 1, 2021, Jackie Corp. purchased

Q95: For each of the following situations, select

Q114: How would you determine the amount of