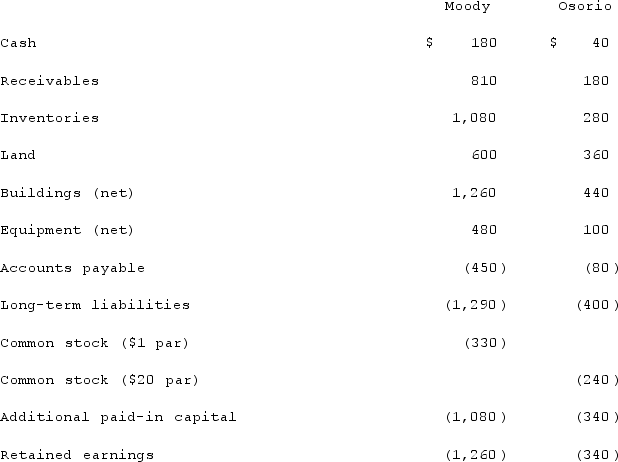

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated inventories at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated inventories at date of acquisition.

Definitions:

Intergroup Conflict

A conflict that occurs between different groups or teams, often resulting from competition for resources, prejudice, or stereotypes.

Stereotypes

Oversimplified generalizations about a group of people that often ignore individual differences within the group.

Stereotypes

Oversimplified generalized beliefs or assumptions about characteristics of particular groups or individuals based on their membership in that group.

Exemplars

Specific instances of a member of a category.

Q1: The Town of Sitka opened a solid

Q3: Kenzie Co. acquired 70% of McCready Co.

Q37: The sequence of activities that flow from

Q45: In governmental accounting, what term is used

Q61: What are the benefits of using pushdown

Q64: On January 4, 2021, Snow Co. purchased

Q64: How are direct combination costs accounted for

Q67: The financial statement amounts for the Atwood

Q78: Fiduciary funds are<br>A)Funds used to account for

Q97: McGuire Company acquired 90 percent of Hogan