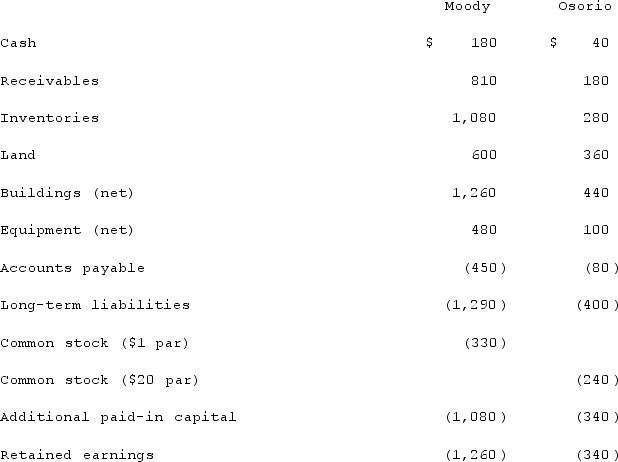

On January 1, 2021, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long-term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows:  Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated buildings (net) at date of acquisition.

Note: Parentheses indicate a credit balance.In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60.Compute the amount of consolidated buildings (net) at date of acquisition.

Definitions:

Antigen

A substance that, when introduced into the body, causes an immune response, often involving the production of antibodies.

Lymphocytes

Granular leukocytes formed in lymphoid tissue. Lymphocytes are generally small. See T Lymphocyte and B Lymphocyte.

Interferon

A protein that blocks viruses from infecting cells.

Chemical Barrier

A defense mechanism in the body that uses chemicals (such as acids or enzymes) to protect against pathogens and foreign substances.

Q11: Walsh Company sells inventory to its subsidiary,

Q20: Prepare the journal entry and identify the

Q21: On January 1, 2021, the Moody Company

Q33: What are the three broad sections of

Q47: When a city holds pension monies for

Q50: Which of the following is a governmental

Q53: On January 1, 2021, the Moody Company

Q55: A company has been using the fair-value

Q72: McGuire Company acquired 90 percent of Hogan

Q111: McGuire Company acquired 90 percent of Hogan