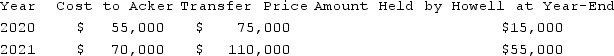

Acker Inc. bought 40% of Howell Co. on January 1, 2020 for $576,000. The equity method of accounting was used. The book value and fair value of the net assets of Howell on that date were $1,440,000. Acker began supplying inventory to Howell as follows:  Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year.What is the balance in Acker's Investment in Howell account at December 31, 2021?

Howell reported net income of $100,000 in 2020 and $120,000 in 2021 while paying $40,000 in dividends each year.What is the balance in Acker's Investment in Howell account at December 31, 2021?

Definitions:

Donations

Voluntary transfers of resources, such as money or goods, to individuals or organizations without the expectation of direct return or compensation.

Spending Variances

Differences between the budgeted or standard cost amounts and the actual costs incurred.

Favorable

A term used in financial analysis to describe a situation, condition, or variance that leads to a positive outcome or better-than-expected results.

Unfavorable

A term often used to describe a variance or result that negatively impacts a business or its financial performance.

Q5: Stark Company, a 90% owned subsidiary of

Q22: How are direct and indirect costs accounted

Q44: Because Jupiter Industries is a very large

Q50: In organizations that use continuous process technologies,<br>A)a

Q64: The Allen, Bevell, and Carter partnership began

Q76: Following are selected accounts for Green Corporation

Q78: Fiduciary funds are<br>A)Funds used to account for

Q101: On January 1, 2020, Barber Corp. paid

Q117: Jones, Incorporated acquires 15% of Anderson Corporation

Q119: Stiller Company, an 80% owned subsidiary of