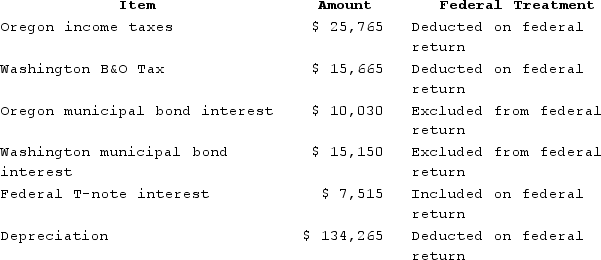

Moss Incorporated is a Washington corporation. It properly included, deducted, or excluded the following items on its federal tax return in the current year:

Moss's Oregon depreciation was $145,515. Moss's federal taxable income was $549,773. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Moss's Oregon depreciation was $145,515. Moss's federal taxable income was $549,773. Assuming Oregon taxes all municipal bond interest, calculate Moss's Oregon state tax base.

Definitions:

Economics

The social science that studies how individuals, governments, firms, and nations make choices on allocating resources to satisfy their wants and needs.

Corporate Controllers

Senior financial officers within a corporation responsible for overseeing accounting functions, financial reporting, and internal controls.

Accounting Functions

The systematic process of recording, analyzing, summarizing, and reporting the financial transactions of a business.

Collateral

Assets pledged by a borrower to secure a loan or other credit, ensuring the lender can seize these assets if the borrower fails to repay.

Q24: Big Company and Little Company are both

Q35: Jordan, Incorporated, Bird, Incorporated, Ewing, Incorporated, and

Q40: Jimmy Johnson, a U.S. citizen, is employed

Q53: ABC was formed as a calendar-year S

Q58: Sin taxes are:<br>A)taxes assessed by religious organizations.<br>B)taxes

Q95: Daniel acquires a 30percent interest in the

Q98: Mel recently received a 30-day letter from

Q101: Lloyd and Harry, equal partners, form the

Q134: Which of the following is true regarding

Q148: The S corporation rules are less complex