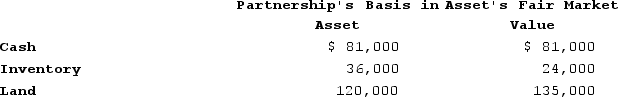

Doris owns a one-third capital and profits interest in the calendar-year DB Partnership. Her adjusted basis for her partnership interest on July 1 of the current year is $20,000. On that date, she receives an operating distribution of her share of partnership assets shown below:

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

What is the amount and character of Doris's gain or loss on the distribution? What is her basis in the distributed assets?

Definitions:

Collaborative Approach

A method of working together that involves mutual engagement of parties to achieve a common goal through sharing knowledge, learning, and building consensus.

Win-Lose Strategy

A strategy that allows one side of a conflict to win at the expense of another.

Lose-Lose Strategy

A conflict resolution outcome in which all parties end up being worse off than before they started negotiating.

Arbitration

A form of dispute resolution where a neutral third party (the arbitrator) makes a decision to resolve a dispute, typically binding on the parties.

Q5: Sybil transfers property with a tax basis

Q5: Congress recently approved a new, smaller budget

Q27: Carmello is a one-third partner in the

Q49: Given the following tax structure, what is

Q51: Evergreen Corporation distributes land with a fair

Q58: Gary and Laura decided to liquidate their

Q65: Randolph is a 30percent partner in the

Q69: Phillip incorporated his sole proprietorship by transferring

Q116: SoTired, Incorporated, a C corporation with a

Q125: PWD Incorporated is an Illinois corporation. It